[ad_1]

If you happen to’re in search of potential stock-market winners this yr, simply look to the sky. Photo voltaic vitality would be the reply to the clear vitality ambitions of nations, and it looks as if time to scoop up shares of photo voltaic shares that signify fast-growing corporations within the house.

Some folks say that the good cash is losing the photo voltaic sector proper now, and so they is likely to be proper about that. In a latest instance, South Korean conglomerate Hanwha Group is reportedly planning to spend $2.5 billion to construct photo voltaic panel manufacturing infrastructure within the US state of Georgia.

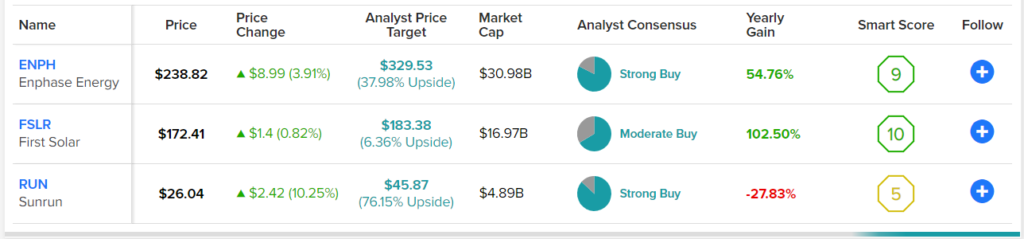

May tax incentives spur extra high-dollar investments in America’s photo voltaic vitality {industry}? The sector actually seems to be heating up, so let’s look at a pattern of the three foremost picks – ENPH, FSLR, and RUN – for future photo voltaic inventory stakeholders.

We’ll begin with an analyst favourite: Enphase Vitality. Shares of this photo voltaic micro-inverter and residential vitality options specialist dropped from $330 to ~$240 final month, so there’s undoubtedly a possible buy-to-let alternative right here.

Enphase Vitality tops the checklist of Finest Photo voltaic Vitality Shares if you display for the most important market caps in that sector. In truth, Enphase Vitality is an {industry} large, as its market cap is over $32 billion. As well as, the corporate has constantly grown its financials, together with earnings and money and money equivalents balances over the previous yr.

You by no means know the place Enphase Vitality might deploy its subsequent industry-leading IQ8 micro-inverters: Arizona, New Hampshire, and wherever else photo voltaic tools is in demand. Goldman Sachs (NYSE: GS) analyst Brian Lee sees ENPH inventory headed for $379 within the subsequent 12 months, so that is your likelihood to achieve publicity to an undisputed market chief.

What’s the Worth Goal for ENPH Inventory?

ENPH has a Sturdy Purchase consensus ranking primarily based on 14 Buys and three Maintain scores assigned within the final three months. Enphase Vitality’s common inventory worth goal of $329.53 implies 38% upside potential.

Like Enphase Vitality, First Photo voltaic has a number of Wall Avenue Purchase scores in addition to Brian Lee’s seal of approval. The Goldman Sachs analyst assigned a lofty $231 worth goal on FSLR inventory, observing that First Photo voltaic “has ~3GW of capability within the US, which positions the corporate as a right away beneficiary of the IRA. [Inflation Reduction Act] manufacturing tax credit.” It actually helps to have authorities funding.

Particularly, First Photo voltaic is a go-to photo voltaic tools supplier for shoppers reminiscent of Minnesota-based Nationwide Grid Renewables, and its $1.2 billion plan to extend US-based photovoltaic panel manufacturing capability will generate shareholder worth.

What’s the Worth Goal for FSLR Inventory?

FSLR has a Reasonable Purchase consensus ranking primarily based on 12 Buys and 6 Maintain scores assigned within the final three months. First Photo voltaic’s common inventory worth goal of $183.38 implies a 6.4% upside potential.

As soon as once more, we have now a favourite analyst with a number of Purchase scores and no Promote scores: residential photo voltaic vitality system provider Sunrun. RUN inventory has been fairly tough in 2022, however appears to be bouncing again into the low $20s because it has completed up to now. So, that is most likely a primary entry level in case you do not have already got a place in Sunrun or need to add to an current stake.

The Finest Photo voltaic Vitality Shares screener exhibits that Sunrun is not almost as massive an organization as Enphase Vitality and First Photo voltaic. Nonetheless, small companies can develop quicker, and Enphase’s 21% year-over-year buyer progress in Q3 2022 demonstrates this level. Additionally, throughout that interval, Enphase Vitality grew its whole income from $438.77 million to $631.91 million – not too shabby.

Moreover, Deutsche Financial institution (NYSE: DBAnalyst Corinne Blanchard assigned RUN inventory a Purchase ranking and $36 worth goal again in November, saying Sunrun is “effectively positioned to learn from accelerating US Residential photo voltaic demand, supported by favorable help for presidency coverage.” Sunrun also needs to profit from $835 million value of financing the corporate just lately secured. So now, let’s have a look at how the analyst group collectively charges RUN inventory.

What’s the Worth Goal for RUN Inventory?

RUN has a Sturdy Purchase consensus ranking primarily based on 13 Buys and two Maintain scores assigned within the final three months. Sunrun’s common inventory worth goal of $45.87 implies 94.2% upside potential.

Conclusion: It is a Good Time to Contemplate Photo voltaic Shares

Wall Avenue spoke, and enthusiastic traders listened. The American photo voltaic {industry} has authorities help, and sector leaders have demonstrated robust financials and robust progress potential.

You might be invited, subsequently, to contemplate ENPH, FSLR, and RUN shares as a worthy addition to your solar-friendly portfolio. Future returns usually are not assured, however the proof means that these three photo voltaic corporations will quickly have their day within the solar.

disclosures

[ad_2]

Source link