[ad_1]

Within the new weekly replace for pv journalOPIS, a Dow Jones firm, supplies a fast overview of the principle worth traits within the international PV business.

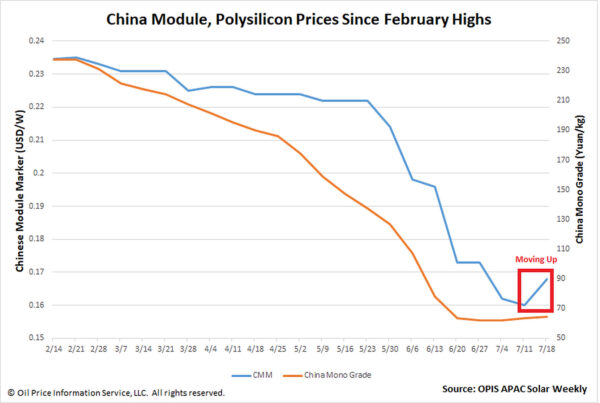

The Chinese language Module Marker (CMM), the OPIS benchmark evaluation for modules from China, rose to $0.168/W, in per week that noticed the market battle with a weakening US Greenback and rising costs throughout China’s photo voltaic worth chain.

This 5% improve – the primary motion of the CMM in virtually six months after latest document lows in accordance with OPIS information – comes as most contacts have observed costs round $ 0.17 / W and identified how the Greenback has declined prior to now days.

China’s upstream sectors, from polysilicon to cells, all noticed positive factors this week, boosting module costs. China Mono Grade, the OPIS evaluation for the nation’s polysilicon, rose for a second week working to CNY64.42/kg, or about $8/kg.

Chinese language module makers are ramping up manufacturing at present, a number of sources agree, though they provide completely different causes for the transfer within the present low worth surroundings.

“Demand is rising now that costs are low,” with the third and fourth quarter being a peak interval for module gross sales, a supply defined. The primary export markets are displaying a standard development price, a photo voltaic business veteran stated. These are smaller, virtually untapped markets of lower than 1 GW every that, when mixed, drive demand, the veteran added.

For the large tier-1 gamers, rising manufacturing has “actually nothing to do with demand,” in accordance with a supply at a kind of firms. A Tier-1 producer can squeeze smaller gamers out of the market and achieve market share if it continues to decrease its costs, in accordance with an skilled market observer.

Going ahead, module costs are unlikely to proceed to rise as a result of extra producers imply intense competitors on this sector, many contacts agreed. “As a way to seize orders, firms select to surrender revenue,” defined a supply. Echoing the sentiment, one other supply stated that there is no such thing as a massive revenue to be made, however it might be higher if the costs may no less than stabilize.

OPIS, a Dow Jones firm, supplies vitality costs, information, information, and evaluation on gasoline, diesel, jet gas, LPG/NGL, coal, metals, and chemical substances, in addition to renewable fuels and environmental commodities. It acquired pricing information belongings from the Singapore Photo voltaic Change in 2022 and now publishes the OPIS APAC Photo voltaic Weekly Report.

The views and opinions expressed on this article are these of the creator, and don’t essentially replicate these held by pv journal.

This content material is protected by copyright and is probably not reused. If you wish to cooperate with us and wish to reuse a few of our content material, please contact: [email protected].

[ad_2]

Source link