[ad_1]

Canadian Photo voltaic Inc. (CSIQ – The Free Report) just lately revealed that CSI Vitality Storage, a part of the corporate’s CSI Photo voltaic subsidiary, has signed a provide settlement with Pulse Clear Vitality in the UK (UK). In line with the phrases of the settlement, CSI Vitality Storage will ship 550 megawatt-hours (MWh) of SolBank’s power storage merchandise to Pulse Clear Vitality.

CSI Vitality Storage can even provide commissioning providers for the merchandise, together with long-term warranties and efficiency ensures.

Advantages of the Settlement

Due to the discount within the costs of storage batteries, the power storage market is witnessing a fast improve in demand in the UK. The power storage market has additionally obtained a major enhance from the UK authorities, as may be seen from over 32 million British kilos value of funding awarded just lately to initiatives throughout the nation, to develop new power storage applied sciences.

Such sturdy funding for power storage initiatives will encourage corporations like Pulse Clear Vitality to construct extra power initiatives, with the corporate having a pipeline of greater than 2,000 MWh of grid -scale battery storage and power optimization alternatives throughout the UK.

CSI Vitality Storage is a distinguished companion with Pulse Clear Vitality, having already signed a deal in Could 2022. Current growth alternatives can even profit Canadian Photo voltaic.

Growth Prospects

The power storage market in Europe, which additionally contains power storage initiatives within the UK, is predicted to witness a CAGR of 16.3% throughout the interval 2023-2028, as anticipated by Mordor Intelligence.

Such a robust prospect of market development will enhance the footprint of Canadian Photo voltaic within the aforementioned market, with the photo voltaic participant having a pipeline of storage initiatives of 8,608 MWh within the area of Europe, Center East and Africa ( EMEA) in September 2022.

Different photo voltaic gamers with a longtime enterprise footprint in Europe must also profit from the aforementioned market development prospects. These are:

Enphase Vitality (ENPH – Free Report) : In September 2022, ENPH expanded its international relationship with the renewable power firm BayWa re to distribute the IQ7 household of microinverters and IQ Batteries in Germany and Benelux. As well as, Enphase expects to provide the third-generation IQ battery beginning in Europe and rising markets within the second half of 2023.

Enphase’s long-term income development is pegged at 47.3%. The Zacks Consensus Estimate for ENPH’s 2022 gross sales implies a development of 66.8% from the 2021 reported quantity.

ReneSola (SOL – Free Report): In October 2022, ReneSola purchased UK-based utility-scale PV and battery storage developer Emeren, which beforehand had a pipeline of greater than 2GW of photo voltaic and 500MW of storage underneath development. -progress. The corporate plans to construct a complete of 200 MW of impartial energy producer property in Europe by the tip of 2023.

The Zacks Consensus Estimate for SOL’s 2022 gross sales implies development of 9.5% from the 2021 reported quantity. SOL delivered a four-quarter common earnings shock of 70.84%.

JinkoSolar Holdings (JKS – Free Report): In Could 2022, JinkoSolar signed the primary European Vitality Storage Resolution (ESS) settlement with Memodo GmbH (“Memodo”). The Memodo exclusivity settlement for JinkoSolar’s ESS product portfolio will cowl the DA-CH area (Germany, Austria and Switzerland) in 2022 and 2023.

The Zacks Consensus Estimate for JKS’ 2022 gross sales suggests development of 83.7% from the reported 2021 determine. The Zacks Consensus Estimate for JKS’ 2022 income suggests development of 80% from the 2021 reported determine. quantity.

Value Motion

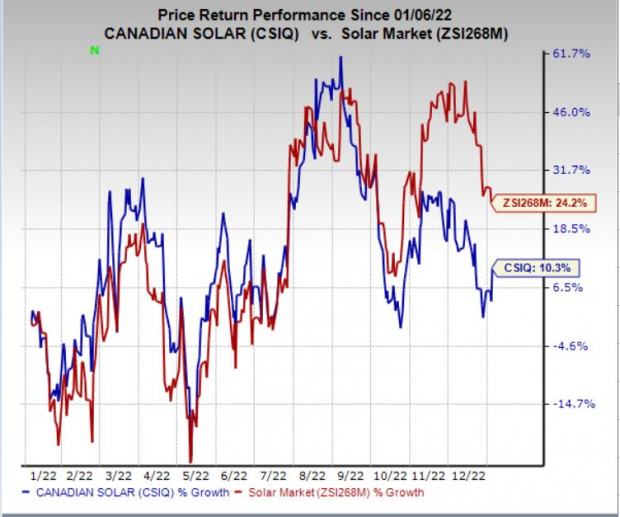

For the yr, shares of Canadian Photo voltaic have gained 10.3% in comparison with business development of 24.2%

Picture Supply: Zacks Funding Analysis

Zacks rank

Canadian Photo voltaic presently carries a Zacks Rank #3 (Maintain). You will notice the whole record of Zacks #1 Rank (Sturdy Purchase) shares at present is right here.

[ad_2]

Source link