[ad_1]

SanderStock

Funding Thesis

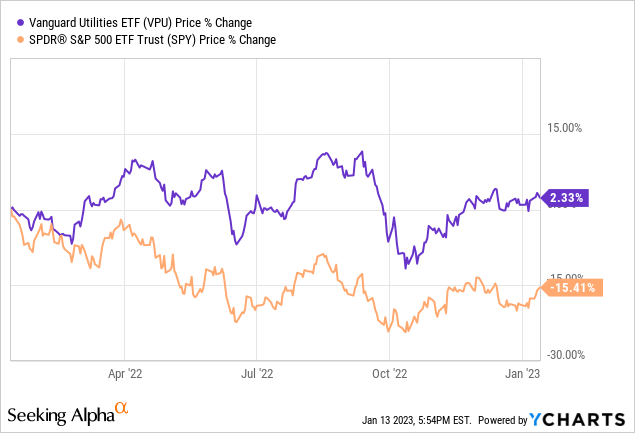

Whereas specialists are sounding the alarm on the US economic system, buyers are more and more searching for shelter in defensive shares, particularly Utilities, characterised by little change in earnings and steady dividends, which spotlight of the sector’s efficiency over the previous twelve months.

The issue is that the shifting regulatory panorama makes the funding determination amongst numerous utility firms extra nuanced than ever. Though the widespread Utility inventory could also be a secure possibility, there are variations of opinion amongst some firms on account of components that embrace regulatory modifications, State and native insurance policies, and company technique in response to those dynamics. Merely put, there are variations within the stage of readiness for present environmental tendencies amongst utility firms within the energy technology market. These variations create dangers and alternatives to determine shares with higher prospects that not solely when these modifications but in addition profit from the time of power transition.

Contemplating these components, I believe NextEra Power (NYSE: NO) is the highest defensive decide for 2023. The corporate gives buyers with a invaluable defensive part of their portfolios, with high-quality revenue and dividend streams, but in addition a progress ingredient not often seen within the sector. Beneath, we have a look at Florida Energy & Gentle “FPL” and NextEra Power Sources/Transmission “NEER,” the 2 important divisions that make up NEE.

FPL

On account of technological and financial components, an electrical utility provider can normally meet the market demand at a lower cost than a set of smaller suppliers can individually. These circumstances should not conducive to wholesome competitors, and ultimately, all however one enterprise will go away the market. In a free market, these naturally occurring monopolies can restrict output and set costs larger than is economically cheap.

Consequently, electrical utility firms are regulated by State, federal, and municipal our bodies that govern billing charges, service circumstances, improvement plans, and power effectivity initiatives. Regulators attempt to stability the pursuits of all events (shoppers, suppliers, buyers, the atmosphere, and so on.) guided by a complete framework that tries to make sure dependable service at an inexpensive value of throughout the aims of the regulator’s atmosphere with acceptable incentives to encourage steady improvement and innovation, together with capability constructing to fulfill rising demand. For FPL, this interprets to a ten% to 11% return on fairness “ROE” as decided by Florida State officers.

FPL will not be solely the biggest electrical utility in Florida but in addition the biggest in the USA, serving 5.7 million folks within the Sunshine State, with 28,450 MW of internet producing capability.

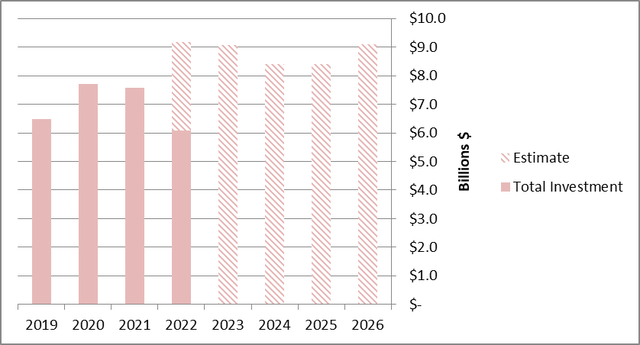

The corporate, I imagine, has an in depth relationship with the officers and has many improvement plans within the State, with a complete backlog of $38 billion in capability and transmission initiatives deliberate for the subsequent 5 12 months, which is greater than depreciation, pointing to a wholesome improve generally. invested capital, and subsequently, revenue.

NEE Capital Investments (NextEra)

There are various components that may have an effect on NEE’s short-term earnings and earnings, together with hurricanes, temperature ranges, and modifications within the value of gas, particularly pure fuel. Nevertheless, this has a restricted impression on money flows, on account of value restoration mechanisms that permit NEE to get well these prices.

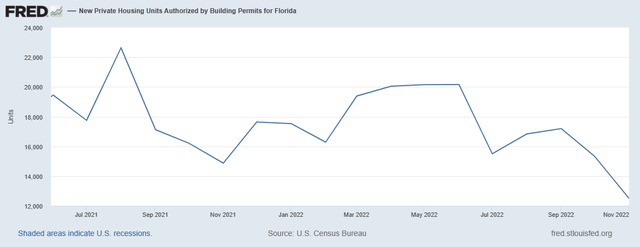

What issues within the case of NEE is its shopper base and consumption per buyer, and these two components are pushed by inhabitants and GDP. We’ve got seen a decline in housing permits in Florida in current months. Nevertheless, I imagine the State is a horny place to stay and work, contributing to above-average inhabitants progress. Final summer season, FPL prospects elevated by 87,000 or 1.5% in comparison with the identical interval final 12 months, pushed by inhabitants progress.

Florida Housing Allow (“FRED”)

NEER

The inventory efficiency of renewable power firms has been underwhelming, underpinned by flawed enterprise fashions, comparable to US photo voltaic panel producers with value disadvantages competing with Asian producers in what necessary commodity market. An instance is Solyndra which is now defunct. Different enterprise fashions within the renewable power sector which have proliferated in recent times are residential photo voltaic power system suppliers which are extra akin to engineering contractors than anything, for instance, SunPower (SPWR).

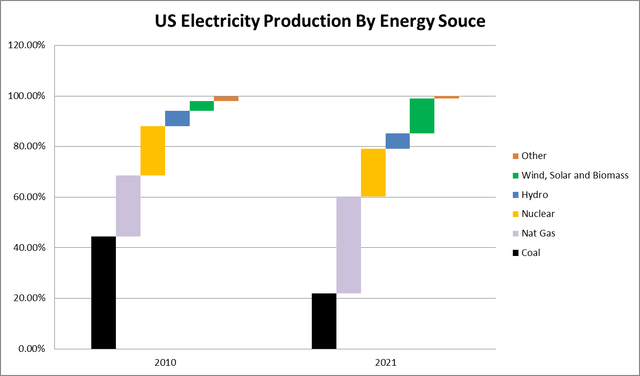

The efficiency of those firms doesn’t mirror the magnitude and velocity of the US power revolution. Regardless of all of the technological, political, and financial obstacles, coal power technology as a proportion of complete electrical energy manufacturing has decreased from 45% to 22% in a decade. That is a formidable charge for an trade as capital intensive and extremely regulated as Electrical Utilities, the place such modifications are sometimes gradual. Fuel generators are the principle alternative for coal mills, however we additionally see robust progress in wind and photo voltaic, with market share rising from 4% to 14% in 2021.

US Electrical energy Manufacturing By Supply (“EIA”)

Tariffs on carbon emissions strangle the coal trade in the identical method they do the communities during which they function. Corporations that aren’t ready for this transition discover themselves in want of capital to increase to much less polluting energy mills to protect technology capability whereas larger demand is met by the like NEE.

As an early adopter of Wind and Photo voltaic power, NEE has benefited from authorities incentives which have allowed it to construct its renewable technology fleet. In 2014 alone, NEE realized $1.6 billion in Money Funding Tax Credit and continues to amortize tons of of thousands and thousands of those advantages yearly.

At this level, Wind and Photo voltaic have reached a adequate scale to compete with different power sources. Now, NEE is making ready itself to make use of the subsequent frontier of presidency subsidies geared toward much less mature elements of the renewable sector, comparable to hydrogen, paved by the not too long ago launched Inflation Discount Act . Final quarter, the corporate introduced that it had begun changing its fuel turbine fleet with hydrogen-powered mills. I imagine there is a chance for NEE to repeat the profitable early adopter financial benefit of Hydrogen.

Stability Sheet and Valuation

A big portion of NEE’s $11.5 billion in debt comes due subsequent 12 months, together with $5.7 billion in debentures and a small quantity of senior unsecured notes. Rates of interest have elevated considerably over the previous few quarters, rising the danger of refinancing. Regardless of these challenges, administration is assured that will probably be in a position to refinance the debt with out difficulty, on account of its robust money circulate place and strong stability sheet. The corporate additionally made the next touch upon rates of interest.

We’ve got $15 billion in rate of interest swaps to handle rate of interest publicity on future debt issuances. With the swaps in place, we’re in a great place to handle the 2023 and 2024 maturities and new debt issuances regardless of the present rate of interest atmosphere. Kirk Crews, Q3 2022.

| NEE Credit score Profile | Debt ($ million) | curiosity | maturity |

| Revolving credit score amenities | $850 | Variable | 2023 |

| Debentures | $5,375 | 2.94 – 5% | 2024 |

| Debentures | $400 | Variable | 2024 |

| Debentures, associated to NEE’s fairness items | $2,000 | 4.60% | 2027 |

| First mortgage bonds | $1,500 | 2.45% | 2032 |

| Senior unsecured notes | $1,444 | Variable | 2024 – 2072 |

At valuation, the corporate is buying and selling above trade averages, however that is regular, given the anticipated earnings and dividend progress in an trade with nearly zero volatility wherever. With a FWD P/E ratio of 34x, and a dividend yield of two%, NEE is unlikely to outperform the market in the long term, however at the least it gives satisfactory safety in case of a recession.

Abstract

NEE’s present enterprise mannequin and long-term technique to grow to be a pacesetter within the power trade positions it properly to grab the alternatives created by the renewable power revolution. The corporate has proven energy and agility because it continues to thrive in a extremely regulated trade. NEE boasts a diversified portfolio of electrical technology property that present steady and predictable money flows over the long run, giving it the flexibility to proceed producing nice returns for buyers regardless of uncertainty. regulatory panorama. As we transfer ahead, I count on the corporate to proceed to ship constant income and earnings progress by way of funding in renewable technology capability and the monetization of its gas-fired technology fleet.

[ad_2]

Source link