[ad_1]

Swiss consultancy Pexapark reported that in March, 23 new PPAs had been signed in Europe with a mixed capability of roughly 2.5 GW. That is the best quantity recorded by Pexapark in a month, and represents a 14% enhance in comparison with February. Though March had seven fewer offers than February, the variety of offers was greater than every other month in 2022.

Within the first quarter of 2023, builders introduced almost 70 PPAs for a complete of 6 GW.

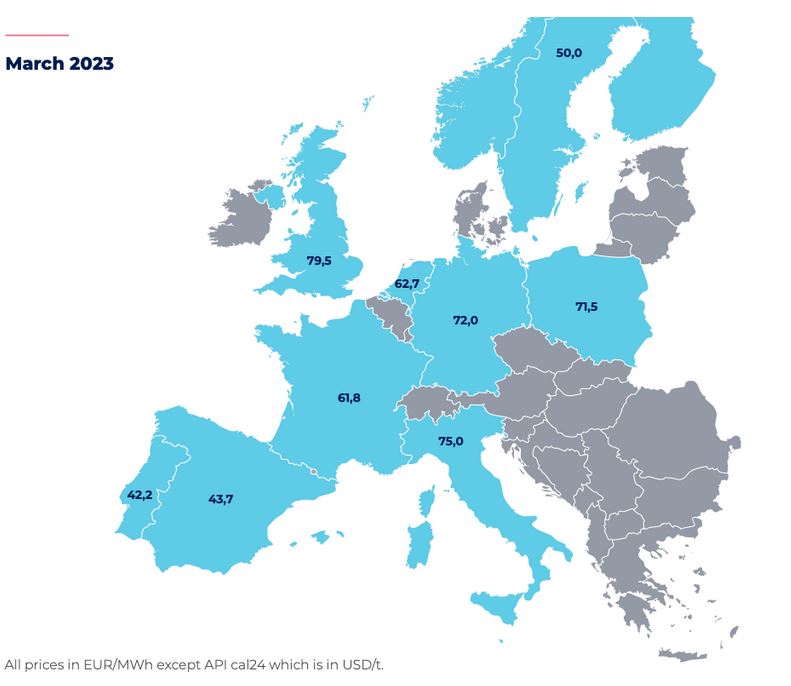

In response to Pexapark, the Pexa Euro Composite noticed a 0.5% enhance in costs in comparison with the earlier month. Spain and Portugal preserve their place with the bottom costs in Europe. In the meantime, the Polish index recorded the most important enhance, rising by 28.9% in comparison with the earlier month. In distinction, the Nordic nations skilled the sharpest decline with an 11.5% month-on-month drop.

Vitality reform

On March 14, the European Fee lastly printed its proposal to reform the design of the EU electrical energy market. The authors of the Pexapark report, a Swiss consultancy, expressed their pleasure after analyzing how a number of the proposed reforms would have an effect on the continent’s Energy Buy Settlement (PPA) market. Nevertheless, the authors be aware that the ultimate laws is just not anticipated earlier than 2025. Nevertheless, the authors consider that the brand new proposal for the reform of the electrical energy market design of the European Fee has the potential to enter the Golden Age of PPAs.

At present, between 100 and 150 transactions happen every year, creating between 10 and 20 GW of latest capability. Pexapark initiatives that the measures included within the reform might generate greater than 1,000 TWh of company demand. This company demand will enhance in tandem with GDP and total electrification efforts, leading to tons of of extra PPAs to help new renewable capability.

Pexapark emphasised that Europe’s transformation right into a “bigger and extra dynamic” PPA market is underpinned by measures that permit new and elevated funding in renewable capability. As well as, the proposed credit score help mechanisms will open the demand for PPAs. “Primarily based on our expertise, credit score has been a key barrier to holding a number of PPAs,” the authors defined. The Fee proposes that initiatives which have already dedicated a part of their era to a PPA will allocate one other a part of manufacturing to patrons who’ve difficulties accessing the PPA market, comparable to small and medium-sized corporations.

This content material is protected by copyright and is probably not reused. If you wish to cooperate with us and wish to reuse a few of our content material, please contact: [email protected].

[ad_2]

Source link