[ad_1]

From pv journal International 05/23

Turkey’s photo voltaic business insiders say the nation has greater than 60 module producers. Murat Guven, founder and CEO of Kaangokay, an impartial PV manufacturing consultancy, listed 72 corporations which are energetic or certified for “funding incentives” however “might cancel it or delay … funding.”

The image affords an excellent distinction to a photo voltaic business that counts just a few, largely small, operators between 2018 and 2020.

“Now we have superb rules now,” stated Tolga Murat Özdemir, vice-president of GENSED (Güneş Enerjisi Sanayicileri ve Endüstrisi Derneği, the photo voltaic business affiliation of Turkey) and CEO of Kontek, an engineering enterprise, buying, and development companies based mostly in Izmir. Citing internet metering guidelines that drive demand, Özdemir added: “For 10 years now we have suffered however we’re working arduous to have good guidelines [for solar] within the place.”

The regulation in query makes for a lovely financial atmosphere for business and industrial (C&I) photo voltaic, specifically, and fertile floor for home producers. Chinese language modules are banned in Turkey, underneath strict anti-dumping guidelines, and C&I arrays with home modules entice tax incentives of 30% or 40%. An additional protectionist measure has seen imported, non-Chinese language modules entice tariffs – apparently based mostly on panel weight – of as much as $95 per panel.

Consequently, the usual Turkish mono-PERC (passivated emitter rear contact) modules can price $ 0.40 per watt technology capability as much as $ 0.43 / W, in comparison with $ 0.22 / W to $ 0.25 / W in China and the remainder of Europe.

Robust demand

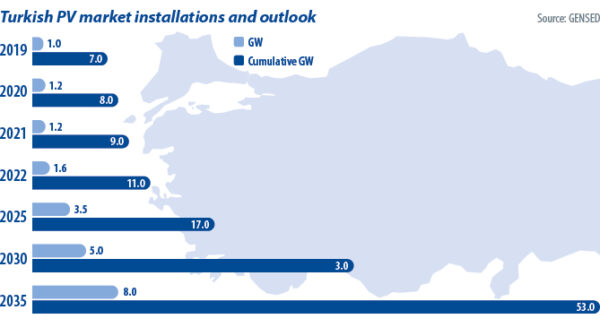

Nonetheless, the Turkish market is creating, if not booming. Whereas the federal government’s set up numbers require some deciphering, GENSED chief Özdemir says that about 2.5 GW of photo voltaic shall be put in in 2022. “Will probably be lower than 3 GW subsequent yr ,” he added.

Some are much less optimistic and put the 2022 determine at 1.5 GW however it’s clear that Turkey’s industrial base is popping to photo voltaic to cut back electrical energy payments. The nation stays depending on vitality imports and main industrial customers are looking for to cut back exports. The 30% to 40% tax incentive out there when utilizing home modules and the online metering tariff construction make C&I photo voltaic enticing. The flexibility to “wheel” off-site PV arrays by means of the grid and to make use of internet metering, is a further kicker for corporations with much less solar-suitable roofs or in larger price areas.

Enter a number of producers

Turkey’s photo voltaic manufacturing sector has responded to sturdy C&I situations, excessive costs, and native manufacturing tax incentives. PV module manufacturing and, to a lesser extent, cell manufacturing, are thriving in Anatolia.

That manufacturing enlargement was on full show on the Solarex commerce present in Istanbul in April. There’s a dazzling array of exhibition cubicles from new Turkish module makers. With panel costs comparatively excessive, and incentives in place, main Turkish industrial corporations are constructing module manufacturing traces to produce their very own C&I initiatives.

“Now we have seen a noticeable progress within the manufacturing facet,” stated Kaangokay founder and CEO Guven. “The principle motive for that is that panel costs, artificially, stay very excessive in Turkey, particularly on the finish of 2021 and all through 2022. Some textile producers in Turkey, who know -an the prices of promoting and world market and extra involved in regards to the border. carbon changes, determined to turn out to be panel producers themselves fairly than paying this excessive revenue margin to the producers.”

Proof of excessive margins is in among the Turkish producer’s disclosures. Antalya-based CW Enerji has been producing photo voltaic modules since 2010 and proudly claims to be the nation’s “408th-largest firm” based mostly on gross sales – tracked by the Istanbul Chamber of Business and Commerce.

Together with module manufacturing, CW Enerji is concerned in your entire PV mission growth provide chain, from funding to operation and upkeep, and plans to checklist publicly. “Within the IPO paperwork, it seems that the corporate will promote the modules with a 19% internet revenue margin by 2022,” Guven stated. This compares to margins of 5.7% in 2020 and 0.3% in 2021. Guven estimates that CW Enerji’s present manufacturing output is simply shy of 900 MW.

Growth above the stream

Presently, the vast majority of photo voltaic manufacturing in Turkey stays module meeting. On account of sturdy demand, bigger and extra established producers are upgrading services to the newest applied sciences: M10 cell codecs, twin glass encapsulation, massive modules, and multi-busbar interconnection, for instance. In addition they adopted negatively doped, n-type cells, particularly TOPCon (tunnel oxide passivated contact) units – pushed by the vagary of the coverage that allowed the import of PV cells from China which have restricted commerce obstacles.

There may be some cell manufacturing capability in Turkey, notably the Kalyon facility outdoors the capital Ankara – which additionally has ingot and wafer manufacturing. Istanbul-based Good Photo voltaic Applied sciences is known to be persevering with to develop cell manufacturing though some cell manufacturing tools suppliers are reporting gradual progress.

China’s HT-SAAE has the longest cell manufacturing monitor report in Turkey, with an annual manufacturing capability of about 800 MW. Nonetheless, since its manufacturing is situated within the “Istanbul Free Commerce Zone,” it’s thought-about outdoors the Turkish customs zone and operates on an export-only foundation. The corporate presently produces cells and modules in its facility for export, with out commerce restrictions, to the US market. It provides Europe, excluding Turkey, from factories in China.

Vertically built-in producer Kalyon, which not too long ago achieved UL certification for its modules, studies that it has achieved its first 25 MW gross sales within the US and can be seeking to improve gross sales overseas. within the nation. Kalyon acknowledges, nonetheless, that “such low costs” that exist in Europe stay an impediment. The corporate has begun its “part three” manufacturing enlargement plan, by which it plans so as to add almost 900 MW of cell capability to TOPCon – bringing its whole cell output to 2 GW. Not all traces will serve Kalyon’s in-house ingot and wafer manufacturing.

“Turkey’s photo voltaic export degree, excluding free zone exports, is round $14 million – with most of those exports going to Syria,” stated Kaangokay’s Guven.

Tools provide

As a result of sturdy demand for upgrading and enlargement, China’s PV module manufacturing tools suppliers are doing sturdy enterprise in Turkey. As proven within the desk beneath, the nation’s established photo voltaic producers work nearly solely with Chinese language line integrators, together with Jinchen, SC-Photo voltaic, and Confirmware.

High 15 energetic PV module producers in Turkey, 2023

| model | 2023 estimated output (MW)* | 12 months of manufacture ESTABLISHING | Primary tools provider (module) | Funding space |

|---|---|---|---|---|

| HT-SAAE | 1,200 | 2016 | Jin Chen | Istanbul (Free Commerce Zone) |

| Schmid- Pekintas | 1,200 | 2013 | SC-Photo voltaic | Duzce |

| Galleon PV | 1,000 | 2020 | SC-Photo voltaic | Ankara |

| Elin-Sirius (OEM: Seraphim-Viesmann) | 970 | 2017 | Jinchen/SC-Photo voltaic | Ankara |

| CW Vitality | 900 | 2016 | Confirmware | Ankara |

| Alpha | 790 | 2013 | – | Kirikkale |

| Energate (OEM: AE Photo voltaic) | 720 | 2021 | Confirmware | Kayseri |

| Good Photo voltaic Applied sciences (OEM: Phono Photo voltaic) | 700 | 2017 | Jin Chen | Istanbul |

| Daxler | 460 | 2019 | SC-Photo voltaic | Konya |

| Mr | 300 | 2017 | Confirmware | Sakarya |

| HSA Photo voltaic Maviçam (OEM: JA Photo voltaic) | 300 | 2021 | Jin Chen | Manisa |

| Gazioglu | 210 | 2012 | Confirmware | Ankara |

| Plurawatt | 200 | 2012 | Confirmware | Ankara |

| Ankara Photo voltaic | 200 | 2014 | Confirmware | Ankara |

| talking | 200 | 2015 | Confirmware | Pamukkale |

* Capability calculations are based mostly on 300 days of operation with three shifts, utilizing M10 cells for photo voltaic panel manufacturing. Some theoretical capacities are estimates. Supply: Kaangokay

Suzhou-based SC-Photo voltaic reported that it provides 16 manufacturing traces in Turkey, with its largest line having an annual manufacturing capability of 500 MW. Smaller manufacturing tools suppliers are additionally gaining floor. Zenith Photo voltaic, which has operations about 300 km outdoors of Beijing, studies that its largest mission in Turkey is the 750 MW module manufacturing capability supplied by CW Enerji. It additionally sells particular person Kalyon units and targets 500 MW tools gross sales in Turkey this yr.

With the outlook for the Turkish market sturdy – GENSED predicts 30% to 35% annual progress till 2035 – it’s conceivable that the nation’s photo voltaic manufacturing sector will turn out to be an necessary hyperlink to the worldwide PV provide chain, with sturdy ties to the Chinese language business and proximity, to the sting of Europe. For this to occur, nonetheless, established gamers should proceed to scale to extend competitors and to additional develop the manufacturing provide chain – a course of that Kalyon is presently embarking on.

Such growth might additionally improve photo voltaic manufacturing facility utilization charges which presently sit at round 30% to 45%, in accordance with Kaangokay CEO Guven. He says, nonetheless, that “it isn’t attainable to make an correct estimate as new producers produce for inventory and a few new producers produce for their very own consumption.” funding mission.”

This content material is protected by copyright and is probably not reused. If you wish to cooperate with us and need to reuse a few of our content material, please contact: [email protected].

[ad_2]

Source link