[ad_1]

Photo voltaic photovoltaic, thermoelectric, and wind power manufacturing

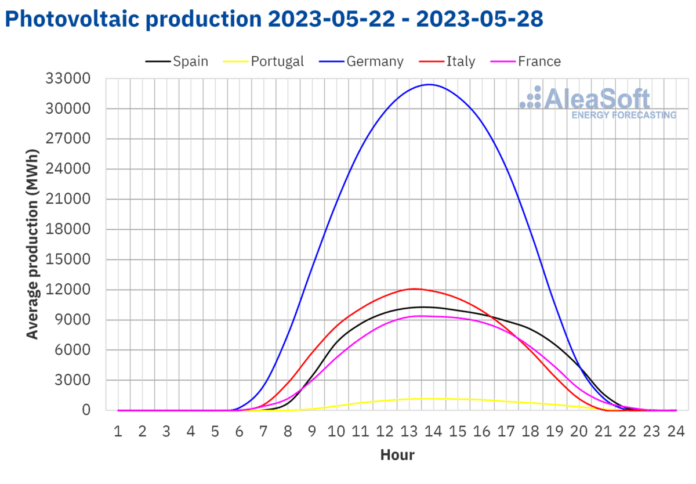

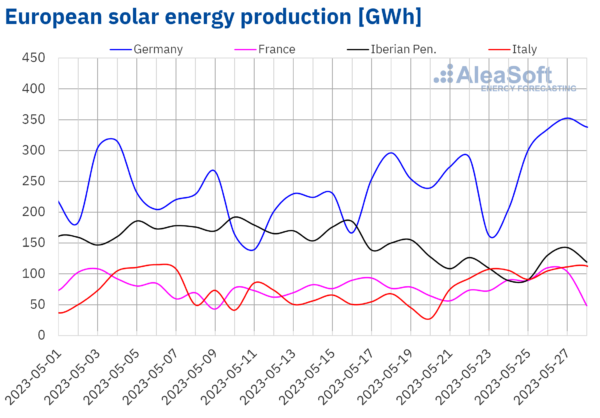

Within the week of Might 22, photo voltaic photovoltaic power manufacturing set a every day document within the markets of Germany and France. Within the French market, a historic manufacturing of 100 GWh was reached on Friday, Might 26, whereas within the German market, on Might 27, a document manufacturing of 353 GWh was registered. Within the Italian market, photo voltaic power manufacturing registered a historic weekly document of 725 GWh, breaking the historic weekly document of 613 GWh registered within the week of April 24.

In comparison with the earlier week, the manufacturing of photo voltaic power elevated in three markets, the Italian market being the one with the most important improve, by 88%. Within the German and French markets, the manufacturing progress of this expertise is 16% and 10%, respectively. Then again, within the markets of Spain and Portugal, after data had been registered final week, the manufacturing of photo voltaic power decreased by 23% and 17%, respectively. For the week of Might 29, AleaSoft Vitality Forecasting’s photo voltaic power manufacturing forecasting exhibits that manufacturing will improve in Germany and Spain, however it could fall in Italy.

Picture: Aleasoft

Picture: Aleasoft

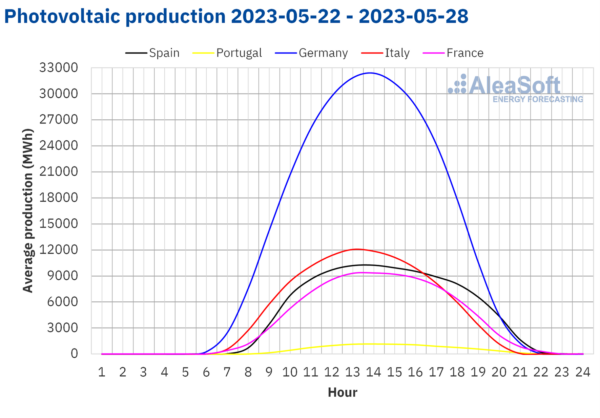

Within the fourth week of Might, wind power manufacturing decreased in all markets analyzed by AleaSoft Vitality Forecasting, in comparison with the earlier week. The most important drop was registered within the Italian market, by 47%, adopted by a fall of 37% within the Iberian Peninsula. Within the German and French markets, the discount was 19% and 6.3%, respectively.

For the present week, AleaSoft Vitality Forecasting’s wind power manufacturing forecasting exhibits that this low pattern will stay in all analyzed markets.

Picture: Aleasoft

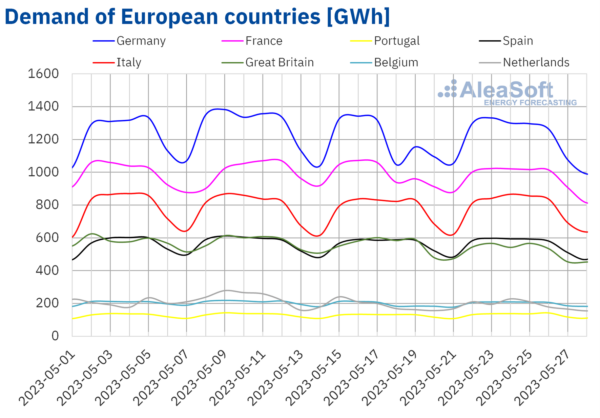

Electrical energy demand

The fourth week of Might ended with a rise in electrical energy demand in a lot of the European electrical energy markets analyzed in comparison with the earlier week. The most important improve, of three.5%, was registered within the markets of Portugal and Belgium, whereas the smallest improve occurred within the Spanish market, at 0.1%. Then again, the markets of Nice Britain and France registered a lower in demand of 5.1% and 1.0%, respectively. Within the case of the markets of Germany, Belgium, and the Netherlands, the rise is because of the restoration of demand after the vacation of Might 18, Ascension Thursday.

In regards to the common temperature, will increase had been registered in comparison with the earlier week in nearly all analyzed markets. Within the case of Nice Britain and France, the rise in temperature led to a lower in demand in these markets, regardless of the restoration in demand from the Might 18 vacation in France.

For the week of Might 29, in response to the demand forecast made by AleaSoft Vitality Forecasting, demand is predicted to lower in all the principle European markets besides Portugal.

Picture: Aleasoft

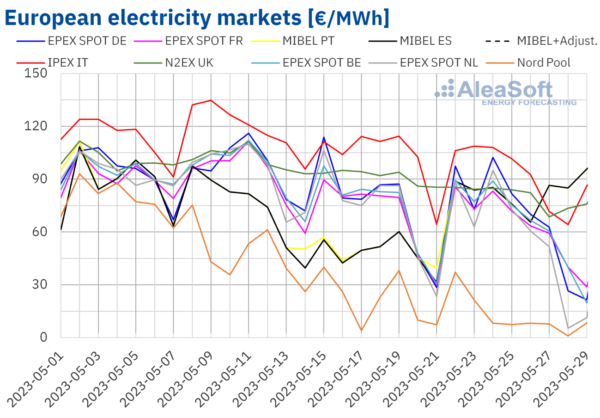

European electrical energy markets

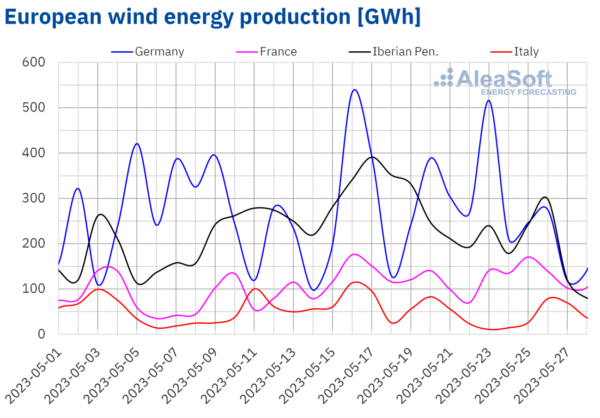

Within the week of Might 22, costs in most European electrical energy markets analyzed by AleaSoft Vitality Forecasting decreased in comparison with the earlier week. The exception is the MIBEL market in Portugal and Spain, with will increase of 64% and 70%, respectively. Then again, the most important drop in costs, which was 39%, was within the Nord Pool market within the Nordic nations, whereas the German, Belgian, and French markets remained with out main variations. . In different markets, costs decreased between 9.6% within the IPEX market in Italy and 13% within the EPEX SPOT market within the Netherlands.

Within the fourth week of Might, weekly costs remained under €100/MWh in European markets. The best common value, €93.29/MWh, is within the Italian market. Then again, the bottom weekly common is within the Nordic market, at €13.02/MWh. In the remainder of the analyzed markets, the costs are set between € 62.40 / MWh within the Dutch market and € 62.40 / MWh within the Portuguese market.

Concerning the hourly value, the adverse hourly value was registered within the Dutch market on most days of the fourth week of Might. On Saturday, Might 27, adverse hourly costs had been additionally registered within the German, French, and Nordic markets. Other than these markets, there have been additionally adverse hourly costs within the Belgian market on Might 28 and 29. The bottom hourly value within the fourth week of Might, of ‑€400.00/MWh, was registered on Sunday, Might 28, from 14:00 to fifteen:00, within the Dutch market and is the bottom on this market no less than since April 2011. Within the Nordic market, a brand new minimal historic document of – €12.93/MWh reached Sunday, Might 28, from 12:00 to fifteen:00.

Throughout the week of Might 22, the discount within the common value of fuel and CO2 Emissions rights, in addition to the rise in photo voltaic power manufacturing, have led to decrease costs on the European electrical energy market. Nevertheless, the discount in wind power manufacturing in markets comparable to German or French is partially compensated for this low pattern and costs stay steady. Then again, within the case of the MIBEL market, the lower in wind power manufacturing within the Iberian Peninsula contributed to the rise in costs on this market.

The value forecast of AleaSoft Vitality Forecasting exhibits that, within the first week of June, costs might proceed to lower in most European electrical energy markets, influenced by the lower in demand. Then again, costs within the Iberian market might proceed to rise, influenced by the low stage of wind power manufacturing.

Picture: Aleasoft

Brent, gasoline, and CO2

Within the fourth week of Might, the settlement costs of Brent oil futures for Entrance‑Month within the ICE market remained above $75/bbl. The weekly minimal settlement value of $75.99/bbl was registered on Monday, Might 22, and is already 1.0% greater than the earlier Monday. The good points continued till Wednesday, Might 24, when the weekly settlement value peak was reached, at $78.36/bbl, which was 1.8% greater than the earlier Wednesday. On Thursday, the settlement value decreased, however within the final session of the week, on Friday, Might 26, it recovered to $76.95/bbl. This value is 1.8% greater than final Friday.

Within the week of Might 22, US debt ceiling negotiations continued to affect Brent crude oil futures costs. As well as, expectations in regards to the upcoming assembly of OPEC + on June 4, in addition to the potential improve in rates of interest in the USA, additionally influenced costs and will proceed to take action within the coming days.

As for TTF fuel futures on the ICE marketplace for the Entrance‑Month, on Monday, Might 22, they reached the weekly highest settlement value of €29.71/MWh, though this value is 8.1% which is decrease than final Monday. Within the fourth week of Might, the settlement costs decreased. Because of this, on Friday, Might 26, the weekly minimal settlement value of €24.52/MWh was reached. This value is nineteen% decrease than final Friday and the bottom since Might 2021.

Within the fourth week of Might, the considerable provide of liquefied pure fuel continued to decrease the affect of the TTF fuel futures value. Knowledge releases on financial developments in Germany and fears in regards to the results of those developments on demand additionally contributed to the worth decline.

About CO2 emission rights futures market EEX for the reference contract of December 2023, on Monday, Might 22, they reached the weekly minimal settlement value of €87.76/t, which is 0.9% greater than final Monday. Nevertheless, this value is €2.12/t decrease than the final session final week. Throughout the remainder of the week, costs continued to lower till the weekly minimal settlement value of € 82.30 / t was registered on Friday, Might 26. This value is 8.4% decrease than final Friday and the bottom since January.

The views and opinions expressed on this article are these of the writer, and don’t essentially replicate these held by pv journal.

This content material is protected by copyright and is probably not reused. If you wish to cooperate with us and need to reuse a few of our content material, please contact: [email protected].

[ad_2]

Source link