[ad_1]

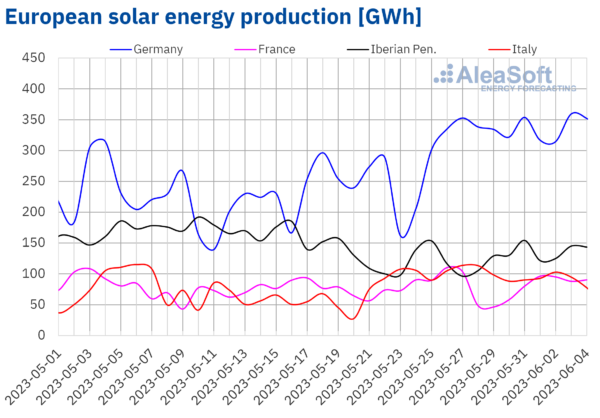

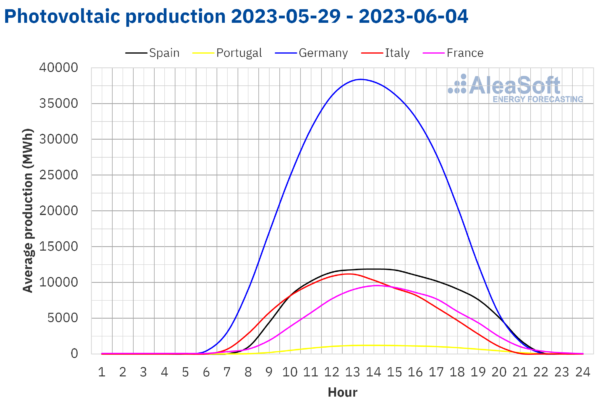

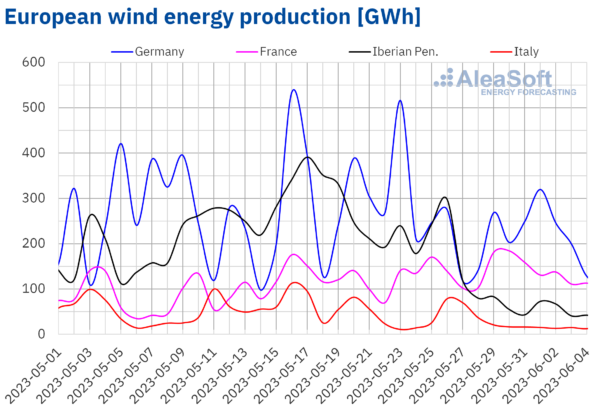

Photo voltaic photovoltaic, thermoelectric, and wind vitality manufacturing

Within the week of Might 29, photo voltaic photovoltaic vitality manufacturing broke the every day report within the German market with 359 GWh generated on Saturday, June 3.

In comparison with final week, photo voltaic vitality manufacturing elevated in three of the primary European markets. The largest enhance, of 29%, was registered in Spain, the place photo voltaic photovoltaic and thermoelectric vitality manufacturing generally is taken into account. Within the German and Portuguese markets, the rise in photo voltaic era was 19% and 9.9%, respectively. However, within the French and Italian markets, the manufacturing of this know-how decreased by 5.9% and 11%, respectively. Within the case of Italy, this discount takes place after the weekly historic report registered final week. For the week of June 5, AleaSoft Power Forecasting’s photo voltaic vitality manufacturing forecasts present that manufacturing will enhance in Spain however could lower in Germany and Italy.

Within the week of Might 29, wind vitality manufacturing decreased in most markets in comparison with the earlier week. Probably the most important drop was registered within the southern European markets, led by a 70% drop registered within the Spanish market, adopted by a 69% drop in Portugal and 58% in Italy. Within the German market, there was a lower of 9.2%, and within the French market there was an 18% enhance in manufacturing. For the week beginning June 5, the wind vitality manufacturing forecasts of AleaSoft Power Forecasting present that will increase may be registered within the Iberian Peninsula and Italy, whereas decreases are anticipated within the German and French markets.

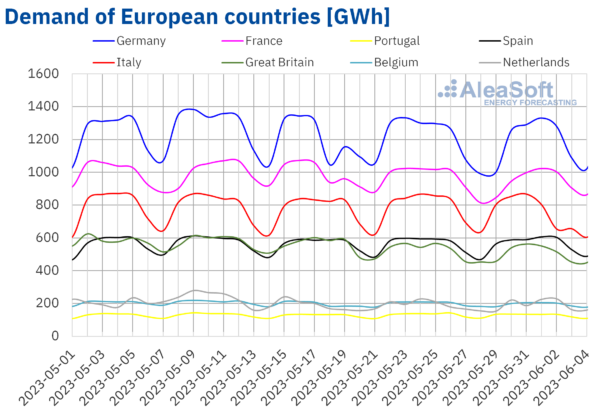

Electrical energy demand

The week that started on Might 29 ended with a lower in electrical energy demand in nearly all European markets in comparison with the earlier week, aside from the Spanish market, the place a rise of 0.9% was registered. The largest fall, of 5.4%, was registered within the Italian market, the place the Italian Republic Day was celebrated on June 2, adopted by a lower of three.7% within the markets of Nice Britain and Belgium, and three.4% and three.2% in Germany. and French markets, respectively. In the meantime, the Dutch market registered the smallest fall, which was 0.4%.

In Germany, Belgium, France, Nice Britain, and the Netherlands, the discount in demand is favored by the vacation of Might 29, Whit Monday.

Relating to the typical temperature, there have been will increase in comparison with final week in all markets besides Nice Britain, the place a drop of 0.2 C was registered. For the week beginning June 5, demand restoration is anticipated in all the primary European markets.

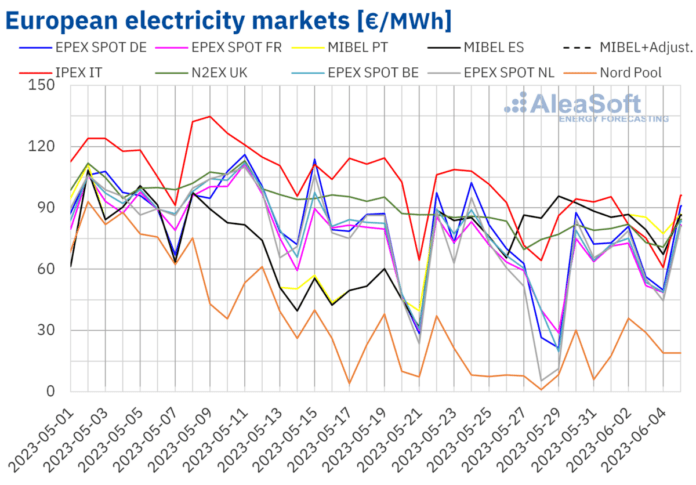

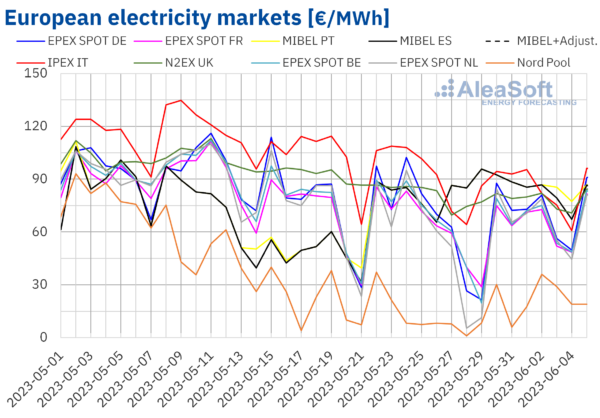

European electrical energy markets

Within the week beginning Might 29, costs in most European electrical energy markets decreased in comparison with the earlier week. The exceptions are the MIBEL market in Spain and Portugal and the Nord Pool market within the Nordic international locations, with will increase of 4.4%, 7.1%, and 60%, respectively. Probably the most important discount in costs, which was 17%, was registered on the EPEX SPOT market in Belgium. In different markets, costs fell between 4.7% on the N2EX market in the UK and 14% on the EPEX SPOT market in Germany.

Within the first week of June, the weekly common worth in European markets remained beneath €90 ($96.5)/MWh. The very best common worth, €87.38/MWh, is within the Portuguese market, adopted by a median within the Spanish market, which is €85.07/MWh. The weekly market worth of MIBEL is the best among the many foremost European markets, and it has not occurred for the reason that week of October 31, 2022. In the meantime, the bottom weekly common is that of the Nordic market , which is €20.86/MWh . In different markets, costs are between €58.68/MWh within the Dutch market and €83.85/MWh within the IPEX market in Italy.

Relating to hourly costs, unfavorable costs have been registered within the Belgian and French markets on Might 29, and on June 3 and 4. Within the German and Dutch markets, along with as of late, there have been hours additionally unfavorable costs on Might 31. Within the case of the Nordic market, unfavorable hourly costs have been reached on Might 29 and 31. The bottom hourly costs within the first week of June, – €185.86/MWh, registered on Monday, Might 29, from 14:00 to fifteen:00, within the Dutch market.

Through the week that began on Might 29, the lower within the common worth of fuel and CO2 emission rights, and the lower in demand, led to a lower within the worth of a lot of the electrical energy markets in Europe. Within the case of the German market, the rise in photo voltaic vitality manufacturing additionally contributed to this conduct, and within the case of the French market, the rise in wind vitality manufacturing. However, within the Iberian market, the place the manufacturing of this know-how registered a exceptional lower, the best common worth was registered. The value forecasts of AleaSoft Power Forecasting present that, within the second week of June, costs could enhance in a lot of the European electrical energy markets, influenced by the rise in demand and the lower within the manufacturing of wind or photo voltaic vitality in some circumstances. Nonetheless, within the MIBEL market, costs may be influenced by the rise in wind vitality manufacturing.

Brent, gasoline, and CO2

On Monday, Might 29, Brent oil futures for Entrance-Month on the ICE market reached their weekly highest settlement worth of $77.07/bbl, which is 1.4% larger than final Monday. Nonetheless, after that, costs fell till they reached the weekly minimal settlement worth of $72.66/bbl on Wednesday, Might 31. This worth is 7.3% decrease than final Wednesday. Through the first two days of June, costs recovered, and the settlement worth on Friday, June 2, was $76.13/bbl, just one.1% decrease than the earlier Friday.

Within the first week of June, negotiations on the US public debt ceiling continued to affect the evolution of the Brent oil futures worth. The settlement reached led to a rise in costs on Friday, June 2, the place the Might employment information in the USA additionally contributed.

However, on the assembly on Sunday, June 4, OPEC+ agreed to proceed the present manufacturing cuts till the tip of 2024. As well as, Saudi Arabia dedicated to additional cuts of 1 million barrels per day beginning in July. This may have an growing affect on costs.

Relating to the TTF fuel futures within the ICE marketplace for the Entrance-Month, after the discount within the fourth week of Might, within the week of Might 29, the settlement costs have been decrease than in the identical days of the earlier week . Nonetheless, the week began with an uptrend. Consequently, on Wednesday, Might 31, the weekly most settlement worth of €26.85/MWh was reached, which is just 3.4% decrease than the earlier Wednesday. Nonetheless, on Thursday, June 1, costs fell by 14% in comparison with the day gone by, and the weekly minimal settlement worth of €23.10/MWh was registered. This worth is 9.2% decrease than final Thursday and the bottom since Might 2021. On Friday, June 2, the settlement worth recovered to €23.69/MWh.

Within the first week of June, TTF fuel futures costs have been influenced upwards by the information of the failure of a liquefied pure fuel plant in Norway. Nonetheless, the excessive degree of reserves in Europe stays beneath €30/MWh. However, the plant affected by the failure is anticipated to return to operation within the second week of June.

Relating to the settlement costs of CO2 emission rights futures on the EEX marketplace for the reference contract of December 2023, within the first week of June, they have been decrease than the identical days final week. On Monday, Might 29, the weekly most settlement worth was reached, €82.86/t, which is 5.6% decrease than the earlier Monday. Nonetheless, this worth is 0.7% larger than the final session final week. However, the weekly minimal settlement worth of €78.72/t was registered on Thursday, June 1. This worth is 5.1% decrease than final Thursday and the bottom since January of this 12 months.

Low fuel costs assist the usage of this gasoline for electrical energy era as an alternative of coal, contributing to decrease demand for CO2 emission rights within the electrical energy sector.

The views and opinions expressed on this article are these of the creator, and don’t essentially replicate these held by pv journal.

This content material is protected by copyright and will not be reused. If you wish to cooperate with us and wish to reuse a few of our content material, please contact: [email protected].

[ad_2]

Source link