[ad_1]

Within the new weekly replace for pv journalOPIS, a Dow Jones firm, gives a fast overview of the principle value tendencies within the world PV business.

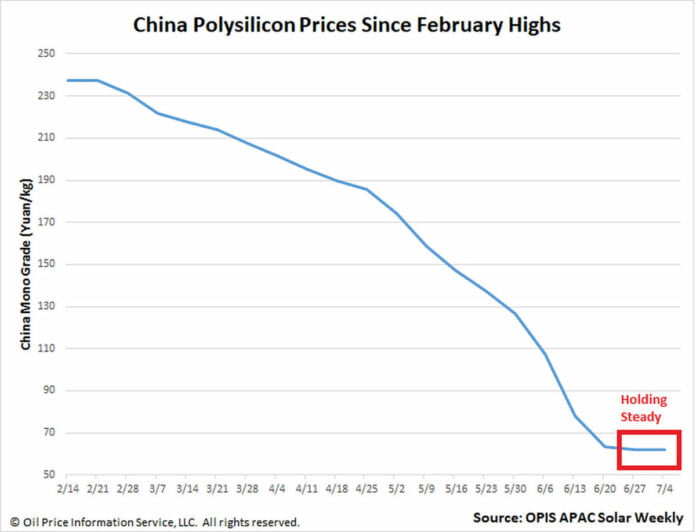

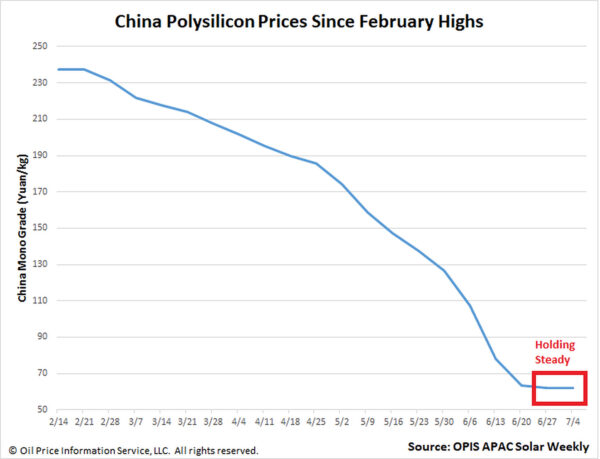

China Mono Grade, the OPIS evaluation for the nation’s polysilicon costs, remained regular at CNY62 ($8.56)/kg on July 4. What appears to be like like a second of calm – catch virtually six months to the following -subsequent, sometimes-dramatic downslides – point out a market that’s busy assessing what is going to occur subsequent.

Trade gamers differed on the place they noticed costs heading after a key polysilicon convention in China final week, with volatility as the highest development. The low values across the CNY60/kg mark, usually thought of the fee determine for polysilicon in China, proceed to be largely the figures revealed through the OPIS market survey earlier this week, though the dialogue in a value rebound emerged.

A supply who noticed polysilicon rising to CNY67/kg learn decrease costs prior to now two weeks as producers cleared inventories earlier than the tip of the second quarter. A polysilicon maker’s stock, estimated at 10,000 MT final week, was mentioned to have halved over the weekend. Energy cuts have affected working charges at monocrystalline crops, a supply mentioned, noting cuts in Baotou, Inside Mongolia, and claiming the identical in Leshan, Sichuan.

The discussions concerning the value improve are additional prolonged under. Wafer costs discovered their backside, agreed with most market individuals, and the wafer phase started to sign potential future notches. A number of sources have confirmed to OPIS that restricted new wafer capability will come on-line within the second half of 2023, doubtlessly preserving greater than 140 GW of annual nameplate capability off the market, in keeping with information from OFFICE.

Chatter apart, the specter of oversupply continues to hang-out China’s polysilicon market. “Polysilicon is clearly overstocked,” one contact reiterated, whereas one other mentioned general “stockpiles are very excessive.” The brand new capability of a serious producer in June of virtually 120,000 MT was delayed, however solely till the third quarter.

OPIS, a Dow Jones firm, gives power costs, information, information, and evaluation on gasoline, diesel, jet gas, LPG/NGL, coal, metals, and chemical compounds, in addition to renewable fuels and environmental commodities. . It acquired pricing information property from the Singapore Photo voltaic Trade in 2022 and now publishes the OPIS APAC Photo voltaic Weekly Report.

The views and opinions expressed on this article are these of the writer, and don’t essentially replicate these held by pv journal.

This content material is protected by copyright and is probably not reused. If you wish to cooperate with us and need to reuse a few of our content material, please contact: [email protected].

[ad_2]

Source link