[ad_1]

From pv journal 05/23.

China is about to turn into the primary nation to put in 100 GW(AC) of photo voltaic a yr. It’s the world’s largest photo voltaic market and exporter of a lot of the world’s PV wafers, cells, and modules. China’s photovoltaic trade has been in improvement for 20 years and has rocketed previously decade to incorporate the export of PV manufacturing tools and course of know-how.

First steps

The trade started in 1968 when researchers from the Institute of Semiconductors of the Chinese language Academy of Sciences found high-resistance n+/p-type photo voltaic cells with higher radiation resistance than p+/n-type cells. . That made the previous eligible to function satellites within the nation through the Cultural Revolution.

Within the Nineteen Seventies and Eighties, the Chinese language authorities established state-owned photo voltaic cell factories in Ningbo, Zhejiang province, and Kaifeng, Henan, to provide small cells and modules for the needs in analysis. The ten kW web site in Yuzhong, 40 km from the town of Lanzhou, is the oldest photo voltaic plant in China. It was constructed by the Gansu Provincial Institute of Pure Power in Yuzhong in 1983, and now produces 70% of its unique output.

PV industrialization

The industrialization of Chinese language PV started with Zhengrong Shi’s basis of Suntech Energy in 2000, with assist from the Wuxi municipal authorities. The College of New South Wales (UNSW) graduate oversaw the opening of Suntech’s first 10 MW annual manufacturing capability cell line in 2002, producing the identical output as China’s whole cell capability. within the final 4 years.

In December 2005, Suntech grew to become the primary personal Chinese language firm to be listed on the New York Inventory Alternate. Suntech’s contemporaries LDK – based in Jiangxi – and Hebei-based Yingli additionally went public in the USA, and the trio grew to become China’s most necessary industrial corporations for a time.

Fast development

The three corporations led China’s first golden age of photo voltaic, from 2002 to 2008, with Longi, Trina Photo voltaic, Canadian Photo voltaic, and JinkoSolar among the many rivals that emerged. Chinese language enterprises, with their manufacturing value benefit and supportive authorities coverage, are constructing a global benefit as demand for PV will increase in Europe and the US.

Initially midstream producers, Suntech, LDK, and Yingli expanded upstream in response to silicon provide constraints, signing long-term provide offers and establishing their very own polysilicon operations.

These investments took successful as the worldwide monetary system suffered a debt disaster in 2008, sharply slowing demand for photo voltaic as debt-ridden international locations rapidly withdrew. of unpolluted power subsidies. With the value of polysilicon falling by 90% inside months, Suntech, LDK, Yingli, and so forth. are dealing with the danger of chapter.

The following imposition, by US and European lawmakers, of anti-dumping and countervailing duties on Chinese language photo voltaic merchandise, in 2011 and 2012, meant that China’s PV producers suffered their darkest time and far is misplaced.

Reset button

Beijing responded by wanting inward and elevating the photo voltaic era capability targets set within the twelfth and thirteenth nationwide five-year plans, for the years 2015 and 2020. that energy additional boosts home demand.

Regional authorities and state entities together with the Nationwide Growth and Reform Fee, Ministry of Finance, Ministry of Science and Expertise, and Nationwide Power Administration (NEA) are pushing initiatives such because the Golden Solar Challenge, Prime-Runner Program, and Panorama Power Base Challenge, to generate home demand for PV.

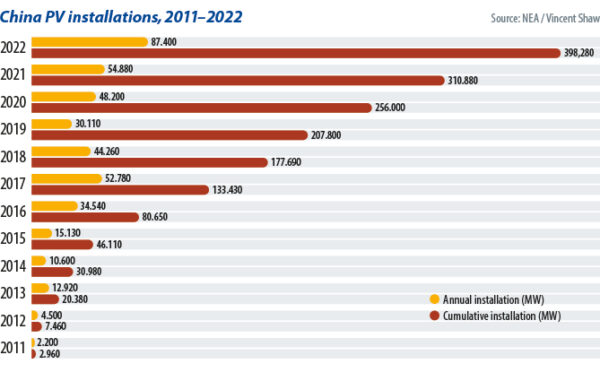

Progress in Chinese language demand, a discount in power value ranges for photo voltaic and the restoration of abroad PV markets noticed photo voltaic rebound in China after 2013.

On Might 31, 2018, nonetheless, as guests to the annual SNEC Shanghai photo voltaic exhibition headed house, the NEA cooled the market in a single day by decreasing PV subsidies, efficient the following day. The transfer comes as China’s rising photo voltaic era capability prompts a rise in incentive charges for a authorities that desires photo voltaic to compete with out subsidies.

Grid parity

Since day one, Chinese language photo voltaic producers have aggressively tried to decrease manufacturing prices. GCL has invested in steady Czochralski silicon and fluidized mattress reactor know-how to cut back the manufacturing value of monocrystalline silicon from greater than CNY 100 ($14.54) per kilogram to lower than CNY 60/kg. Longi’s diamond-wire slicing of monocrystalline silicon ingots has pushed down the price of wafers and Longi and peer Aiko Photo voltaic had been among the many first corporations to spend money on passive emitter, rear contact (PERC) photo voltaic cells as a extra environment friendly different to the mainstream. that BSF. (back-surface discipline) incumbent.

Module makers together with Trina Photo voltaic, JinkoSolar, and CSI have developed new approaches together with multi-busbar know-how, half-cut cells, bifacial panels, stacked tiles, and bigger wafers.

The ensuing merchandise may produce subsidy-free electrical energy on the identical value as grid energy in some areas by 2019, and in most initiatives two years later, as Beijing ends subsidies.

Chinese language Premier Xi Jinping in 2020 introduced that the nation will purpose for peak carbon emissions in 2030 and carbon neutrality in 2060. The greater than 100 GW(AC) of recent photo voltaic capability anticipated this yr may hit greater than 130 GW subsequent yr, based on commerce physique the China Photovoltaic Business Affiliation.

Coverage assist

The Chinese language authorities’s means to intervene within the home financial system units it other than US and European authorities who should rely solely on fiscal coverage and tax levers.

The nascent Chinese language photo voltaic trade imports uncooked supplies and manufacturing tools and depends on exports to develop, which initially prompted Beijing to supply tax incentives linked to manufacturing.

When the US and EU slapped duties on Chinese language merchandise, policymakers flocked to sources of capital and used market competitors to bolster PV corporations whereas providing tax incentives and supporting land use coverage. That important response established a whole provide chain with Chinese language uncooked supplies and manufacturing tools, and boosted native demand.

Residence comforts

China has the most important single market on the earth in addition to a complete industrial system and comparatively low labor prices, permitting it to benefit from its scale and acquire a aggressive value benefit. On the identical time, the nation’s infrastructure is comparatively steady. Built-in transportation can enhance logistics effectivity and considerably scale back prices and a well-developed communication system will help corporations combine provide chain assets and create cluster results.

For a typical Chinese language module producer, the uncooked materials for the monocrystalline silicon in its modules might come from silicon vegetation in Internal Mongolia or Qinghai. Silicon ingots come from vegetation in Yunnan and are processed into high-efficiency photo voltaic cells in factories close to module vegetation in Jiangsu or Zhejiang.

These supplies are despatched to the module fabs the place they’re processed with auxiliary supplies and equipment offered by close by suppliers and at last despatched to the west and northwest of China, for the development of ground-mounted energy. vegetation, or to ports within the east for export.

Non-public vs. public

Not like most different home industries, most of China’s main PV gamers are personal corporations, with Miao Liansheng proudly owning Yingli, Gao Jifan Trina Photo voltaic, and Peng Xiaofeng LDK. Non-public possession implies that such corporations have low decision-making hierarchies and might rapidly reply to market adjustments, in contrast to their state-owned friends. In comparison with extra conventional industries, China’s photo voltaic sector has operated in a extremely worldwide and specialised free market setting from the start.

On the identical time, most personal entrepreneurs in China are skilled and open-minded and are usually extra brave within the face of infinite market challenges than their counterparts in conventional sectors. Even the imposition of EU and US duties, or the drastic adjustments in China’s nationwide coverage, or fluctuations in provide chain costs, didn’t shake their willpower to develop the PV enterprise. .

Above all, the Chinese language authorities has proven robust religion and willpower to interchange conventional fossil-fuel based mostly electrical energy with renewable power. It’s the foundation of the event of the complete PV trade in China and it seems to be steady and dependable.

Predominant challenges

Chinese language PV nonetheless faces many uncertainties that would have an effect on future development, nonetheless.

First, the world financial system is now dealing with the danger of recession. The World Financial institution, World Commerce Group, and OECD lowered their development forecasts for the worldwide financial system final yr and this, and warned economies dealing with an elevated threat of recession attributable to of rising meals and power costs, inflation, and better rates of interest in developed international locations.

The outlook for the Chinese language financial system is equally bleak. After a horrible expertise within the prevention and management of Covid-19 final yr, China is within the midst of a troublesome restoration and a decline within the property market, sluggish automotive gross sales, and the home debt. that authorities of disaster proportions all check the financial system. The anticipated decline will result in a lower in demand for electrical energy, together with renewable power, which is able to straight have an effect on the event of the photo voltaic sector.

On the identical time, geopolitical dangers are additionally looming. Main photo voltaic markets within the EU, US, and India have all introduced an intention to construct their very own PV provide chains. Does this imply that extra commerce safety insurance policies might be launched? Will there be extra commerce limitations to be erected in opposition to Chinese language PV merchandise?

Different challenges in China embody whether or not the grid can accommodate greater volumes of intermittent renewable era capability. Will the obligatory power saving ratios imposed by native governments on renewable websites – together with PV – result in important value will increase that hurt funding?

Regardless of the storm clouds, nonetheless, China’s achievement of 100 GW(AC) annual photo voltaic installations continues to be worthy of congratulations from all concerned within the power transition and confirms the intense way forward for the enterprise the place we’re shifting.

This content material is protected by copyright and is probably not reused. If you wish to cooperate with us and wish to reuse a few of our content material, please contact: [email protected].

[ad_2]

Source link