[ad_1]

Researchers in Spain studied the impression of hydrogen manufacturing and storage applied sciences on danger administration for power communities with an inner value tariff system. They discovered that one of the best participation in futures markets and spot markets relies on the danger aversion and self-sufficiency of the group.

Power communities have the potential to encourage funding in clear applied sciences, coordinate teams of prosumers, and cut back their power payments. Nonetheless, there are challenges at each the operational and financial ranges that must be addressed with a view to promote totally different power group fashions.

Researchers on the College Carlos III of Madrid modeled the operation of an power group with renewables and storage below totally different technical and financial circumstances and analyzed the impression of recent hydrogen manufacturing and storage applied sciences on group operation and danger administration.

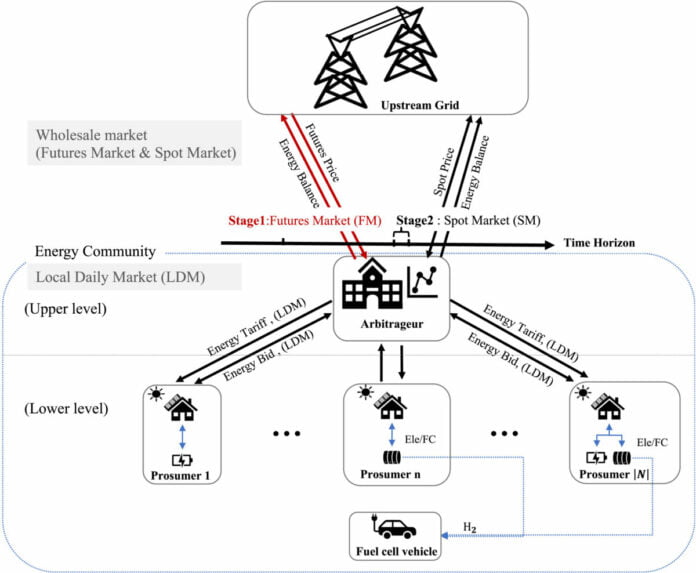

They examine how group administration might be carried out instantly by an arbitrageur who, utilizing an enough price-based response to demand (real-time pricing) system, serves as an middleman within the central electrical energy market to coordinate several types of prosumers below danger aversion.

Their outcomes present that optimum participation in futures and space markets is extremely conditioned by group danger aversion and self-sufficiency ranges. In addition they discovered that the exterior hydrogen market has a direct impression on the interior price-tariff system of the group, and relying available on the market circumstances, the utility of particular person prosumers could worsen.

“We present how an arbitrageur can successfully coordinate the operation of many prosumers and handle uncertainty by taking part in a two-stage wholesale market and by setting an enough demand response program,” the researchers wrote in “Danger administration in power communities with hydrogen manufacturing and storage applied sciences,” not too long ago printed in Utilized Power.

The arbitrageur hedges his danger by allocating a good quantity of buying and selling within the futures market and by charging prosumers a real-time pricing mechanism when spot market buying and selling happens.

“Concerning the danger facet of buying and selling, we will observe that the upper the extent of self-sufficiency within the power stage of the group, the decrease the impression of potential adversarial conditions,” stated the researchers.

In addition they noticed how excessive danger aversion ranges can cut back ahead buying and selling in durations with low renewable technology whereas rising ahead buying and selling in durations with excessive renewable technology. As well as, they discovered that the battery storage system can successfully assist shift the load for prosumers, decreasing their working prices and benefiting all the group. In the meantime, an exterior hydrogen market would assist prosumers carry in additional income, whereas additionally managing price volatility.

This content material is protected by copyright and might not be reused. If you wish to cooperate with us and need to reuse a few of our content material, please contact: [email protected].

[ad_2]

Source link