[ad_1]

From pv journal USA

The US Inflation Discount Act of 2022 consists of $370 billion in spending for renewable vitality and local weather measures. The invoice consists of greater than $60 billion for home manufacturing all through the clear vitality provide chain. This historic degree of funding is vital to reaching America’s manufacturing freedom and clear vitality safety.

A current report from Wooden Mackenzie signifies that builders, engineering procurement development (EPCs) corporations, and producers can be looking out for steering from the US Treasury Division and the IRS for readability to plan. in new photo voltaic growth and funding in new manufacturing services. inside the US.

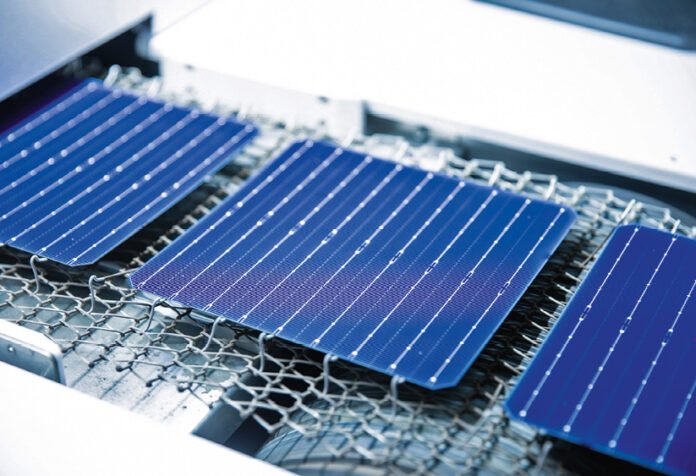

The report seems to be at tendencies on this rising trade, together with a give attention to TOPCon heterojunction (HJT) modules, progress within the world residential inverter market, an growth in tracker manufacturing, an anticipated decline in photo voltaic venture prices and an summary of future challenges. .

TOPcon vs. MINUTE

TOPCon, which stands for tunnel oxide passivated contacts, is predicted to surpass heterojunction (HJT), and the Wooden Mackenzie report says that mono PERC “is the expertise that balances maturity and effectivity”, indicating that TOPCon has most progress potential because of the course of. enchancment and value optimization.

“PERC panel expertise additionally has a really quick studying curve and the stability between them will rely on which one is ready to improve effectivity or scale back prices sooner than the opposite,” Stefan Gunz, the pinnacle of photovoltaics analysis at Fraunhofer in Germany. Institute for Photo voltaic Power Programs (ISE), mentioned pv journal a yr in the past.

Wooden Mackenzie analysts estimate that TOPCon modules attain 25% effectivity in mass manufacturing and may improve to twenty-eight.7%

Upgrading manufacturing from mono PERC manufacturing to TOPCon is an easy and comparatively low-cost funding, and analysts estimate {that a} lab effectivity of 27% will be achieved by enhancing metallization and thinner wafers. Wooden Mackenzie says that some producers anticipate the common wafer thickness for large-format TOPCon modules to lower by 20 μm this yr to 120 μm, which is able to result in many of the reductions in value in 2023.

The Inflation Discount Act inspired module manufacturing within the US because of $30 billion in manufacturing tax credit in addition to $10 billion in funding tax credit to construct clear expertise manufacturing services. Wooden Mackenzie expects US module manufacturing capability to exceed 15 GW by the tip of this yr.

The massive query, nevertheless, is the definition of “home-made elements”, and whether or not it implies that the modules are assembled in the US, or whether or not all of the elements are made within the US. The problem for module makers is that there’s just about no wafer or cell manufacturing within the US, though that has modified with current bulletins by corporations together with Qcells and CubicPV. The distinction within the interpretation of home content material “might considerably have an effect on the capability to provide the module within the subsequent 5 years”, the report argued. Analysts estimate that round 45 GWdc of latest capability bulletins will come on-line by 2026.

Inverters, trackers

The anticipated progress of photo voltaic within the US will stream by the provision chain, which is able to improve the expansion of inverters and trackers, and different supporting elements. The Wooden Mackenzie report says that current coverage modifications, together with the EU’s REPowerEU, India’s implementation of Manufacturing Linked Incentives (PLI) and the US IRA, will speed up the adoption of photo voltaic on this nations, thereby serving to nations obtain their internet zero targets.

Based on the report, the residential inverter market will develop worldwide by 2023. With rooftop photo voltaic gaining momentum, particularly in nations like India and Germany, there can be a corresponding progress out there for microinverters, string inverters and DC optimizers. , the preferred inverter choices for rooftop installations. In truth, string inverters with a number of most energy level trackers (MPPTs) will see elevated market penetration by 2023.

Residential inverters will see extra use of synthetic intelligence in its algorithms. Module-level energy electronics (MLPEs) and single-phase string inverters, the preferred in rooftop photo voltaic installations, will see an 11% market share in world inverter shipments by 2023. Inverter manufacturing will improve with main gamers including manufacturing traces and new entrants becoming a member of the market, and the following competitors will trigger value reductions from 2% to 4% in 2023.

An ongoing problem for inverter producers is the worldwide chip scarcity, which Wooden Mackenzie analysts anticipate to proceed by 2023 and spill over into 2024. The scarcity is inflicting inverter producers to take chips from low-end producers earlier than conducting rigorous in-house testing to make sure the standard, effectivity and lifetime of their inverters. Wooden Mac predicts that inverter costs will not drop till later this yr.

Home tracker manufacturing is gaining momentum in lots of elements of the world as a result of authorities incentives in addition to logistical points skilled through the COVID-19 pandemic. Based on Wooden Mackenzie analysts, tracker costs will drop in India and the US. They anticipate additional stability in metal provide within the US and India, particularly with the growth of present metal manufacturing. Europe, nevertheless, will nonetheless face an imbalance within the metal market. As greater than 60% of the tracker composition is metal, this rebound in metal demand will lead to extra competitors within the tracker market share for distributors, mentioned Wooden Mackenzie analysts, who venture that the value of 2023 for trackers will fall to five% in the US, Brazil and China.

Photo voltaic prices

Capital expenditure prices will proceed to say no, pushed partly by elevated use of TOPcon modules. Wooden Mackenzie analysts additionally anticipate the value of polysilicon to drop this yr they usually estimate that the present 300 GW of world capability will attain 900 GW by the tip of 2023.

“We estimate that over 1 million Mt of polysilicon growth will come on-line by 2023. Many of the new capability can be in China. Nonetheless, we imagine that the roughly 10% scheduled to be exterior of China might command a value premium as it could be exempt from tariffs and different coverage dangers. .

An ongoing problem is the uncertainty surrounding antidumping/countervailing (AD/CVD) tariff prices. With the US Division of Commerce anticipated to announce its closing dedication in Might 2023, Wooden Mackenzie estimates that duties might vary from 16% to 254% primarily based on the nation of origin. The preliminary dedication, launched in December 2022, discovered tier 1 corporations, reminiscent of Trina, BYD, Vina (a unit of Longi) and Canadian Photo voltaic, evading Chinese language tariffs. The preliminary dedication removes Hanwha and Jinko which is able to lead to some aid in module availability in 2023.

In the US, builders will proceed to give attention to IRA necessities, together with prevailing wages and home content material bonus additions for utility-scale tasks that start development in 2023. For tasks To get the complete 30% funding tax credit score or the manufacturing tax credit score, all tasks bigger than 1 MWac should pay their employees a minimal wage and set up an apprenticeship program.

In Europe, the REPowerEU coverage goals to put in 320 GW of photo voltaic PV by 2025 and 600 GW beneath the EU photo voltaic vitality technique. To attain these formidable targets, it’s needed to determine a powerful manufacturing hub throughout the area. The brand new European Photo voltaic Photovoltaic Trade Alliance, will create a framework to assist safe financing for the manufacturing and growth of analysis and innovation in module expertise, and different zero-carbon applied sciences.

The ultimate problem for PV manufacturing in Europe, based on Wooden Mackenzie analysts, is the fee competitors from the APAC area as a result of increased vitality, labor and materials prices, however can profit from prospects who’re keen to pay a premium for higher expertise and provide chain transparency.

This content material is protected by copyright and will not be reused. If you wish to cooperate with us and need to reuse a few of our content material, please contact: [email protected].

[ad_2]

Source link