[ad_1]

Photo voltaic photovoltaic and thermoelectric power manufacturing and wind power manufacturing

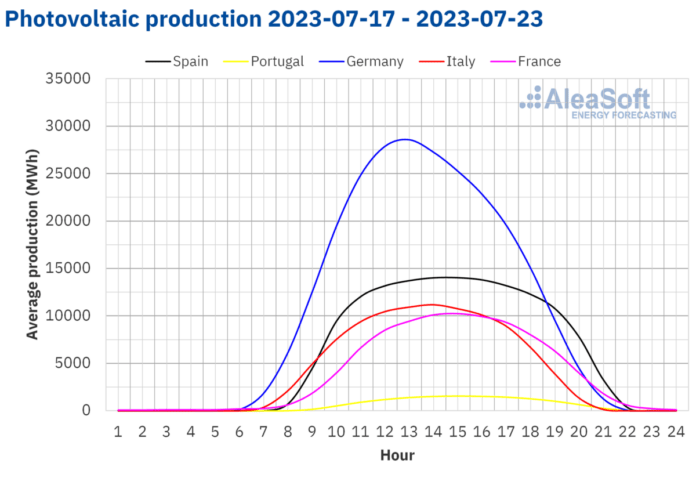

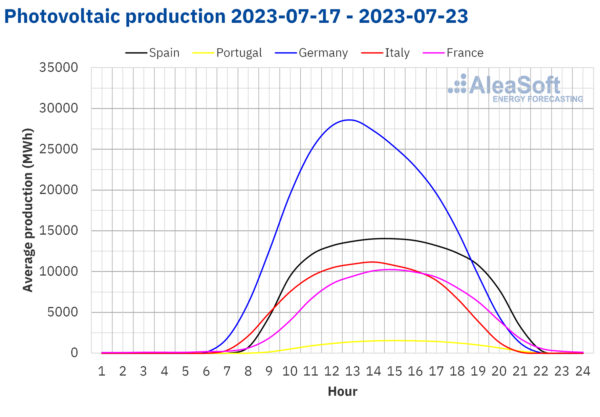

Within the third week of July, photo voltaic photovoltaic power weekly manufacturing in France reached 650 GWh, a historic report for the French market. In comparison with the earlier week, manufacturing elevated by 4.7%.

In the remainder of the analyzed markets, photo voltaic power manufacturing fell. The Italian market had the bottom decline of 0.8%. Within the markets of Spain and Portugal, manufacturing decreased by 4.3% and 5.8% respectively. The largest lower was registered within the German market, which was 10%.

For the week of July 24, AleaSoft Vitality ForecastingThe forecast of photo voltaic power manufacturing signifies a rise within the Spanish market, whereas the German and Italian markets are anticipated to lower.

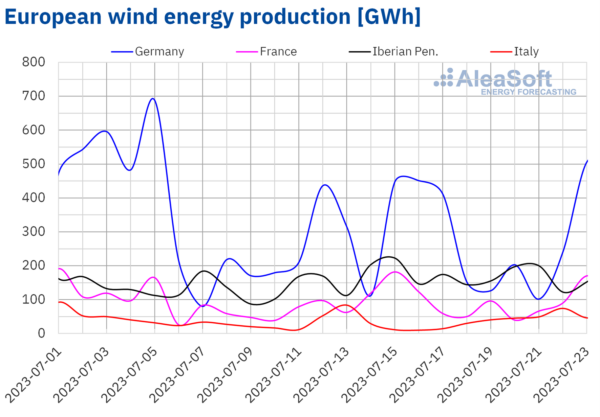

In the course of the week of July 17, wind power manufacturing elevated within the Italian and Spanish markets in comparison with the earlier week. The Italian market had the very best improve of 40%, whereas the Spanish improve was 4.9%.

The markets of Germany, France, and Portugal, had a discount in wind power manufacturing throughout the identical interval. The largest discount was registered in Germany and France, underneath 19% in each circumstances. Within the Portuguese market, wind power manufacturing was 11% decrease than final week. On Thursday, July 20, 45 GWh was registered, the very best every day manufacturing till July.

For the final week of July, AleaSoft Vitality ForecastingThe forecast of wind power manufacturing signifies a rise within the Italian, German, and French markets. A decline available in the market is predicted in Spain and Portugal.

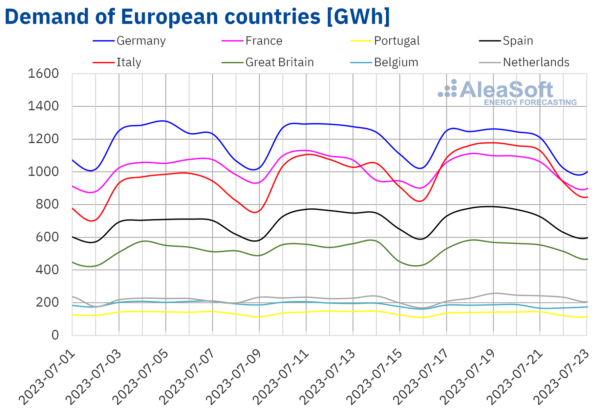

Electrical energy demand

Within the week of July 17, the electrical energy demand rose in most analyzed European markets in comparison with the earlier week. The largest improve was 6.6%, which was registered within the Italian market. Moreover on Wednesday, July 19, the very best demand because the finish of July 2015 was recorded, at 1179 GWh. On the identical day, the second highest temperature of 2023 was registered in Italy.

The second market with the most important improve in demand was the Netherlands, with a rise of 6.3%. There was a rise of 0.4% within the Spanish market and a pair of.9% within the British market. Within the case of Spain, the demand on Wednesday, July 19, reached 787 GWh, the very best registered because the finish of January 2021, and that is the day with the very best common temperature of the yr to this point in Mainland Spain.

Though the common temperature because the week fell in some markets in comparison with the earlier week, the excessive temperatures registered on many days of the week favored a rise in demand. Within the case of France, the rise in demand was attributable to the return to work after the vacation on Friday, July 14, the French Nationwide Day.

Demand in Belgium, Germany, and Portugal decreased throughout the evaluation interval. The largest decline was registered within the Belgian market, which fell by 6.1%. Within the German market and the Portuguese markets, demand fell by 3.2% and a pair of.0%, respectively.

For the final week of July, in keeping with demand forecasts made by AleaSoft Vitality Forecastingdemand is predicted to drop in many of the predominant European markets examined, aside from Portugal, the Netherlands, and Nice Britain.

European electrical energy markets

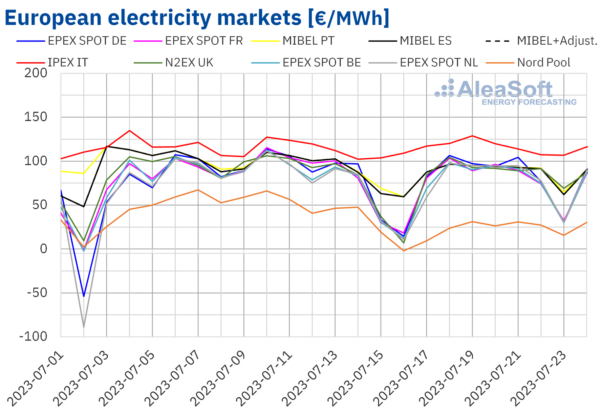

Within the week of July 17, the costs of many of the electrical energy markets in Europe had been checked by AleaSoft Vitality Forecasting elevated in comparison with final week. The exceptions are Nord Pool market within the Nordic nations, with a fall of 40%, and the MIBEL market in Spain and Portugal, with a slight downward development resulting in a lower of 1.6% and a pair of.1%, respectively. The largest worth improve in N2EX market in the UK, elevated to 18%. In different markets, costs rose 2.0% to IPEX market in Italy and 9.2% of EPEX SPOT market within the Netherlands.

Within the third week of July, the weekly common was under €90/MWh in virtually all European electrical energy markets. The exception is the Italian market, which has the very best common worth, which is €116.31/MWh. The bottom weekly common is within the Nordic market, which is €23.49/MWh. In the remainder of the analyzed markets, the costs are between €78.37/MWh within the Belgian market and €89.00/MWh within the British market.

Concerning hourly costs, on Sunday, July 23, from 14:00 to 17:00, a worth of €0.00/MWh was registered within the Spanish market. It additionally occurred on the identical day within the Portuguese market, from 16:00 to 17:00, and on July 17 within the Nordic market, from 14:00 to fifteen:00. Within the case of the Belgian and Dutch markets, the detrimental hourly worth was registered on Monday, July 17.

On Sunday, July 23, detrimental costs had been registered within the German, Belgian, French, and Dutch markets, which had been influenced by sturdy wind and photo voltaic renewable power manufacturing, particularly in Germany, mixed with decreased demand over the weekend.

The bottom hourly worth, of ‑€52.65/MWh, was reached on Monday, July 17, from 12:00 to 13:00, within the Dutch market. Alternatively, on Wednesday, July 19, from 19:00 to twenty:00, the worth of €205.00/MWh was reached within the Italian market, the very best on this market since April.

In the course of the week of July 17, the rise in demand, the lower in wind and photo voltaic power manufacturing in most analyzed European markets and the rise in CO.2 The costs of emission rights have led to a rise in costs on the European electrical energy market. As well as, though the common worth of fuel is decrease than final week, the weekly costs registered an upward development all through the week.

AleaSoft Vitality ForecastingThe value forecast exhibits that, within the fourth week of July, costs might lower in most European electrical energy markets, influenced by the lower in electrical energy demand in some markets and the rise in wind power manufacturing in Germany, France, and Italy.

Brent, gasoline and CO2

Brent oil future for Entrance-Month of ICE market, on Monday, July 17, the weekly minimal settlement worth was registered, which was $78.50/bbl, which was 1.0% greater than the earlier Monday. Within the following periods within the third week of July, the settlement worth was greater, however remained under $80/bbl. Nonetheless, on Friday, July 21, the weekly most settlement worth, which was $81.07/bbl, was reached. This worth is 1.5% greater than final Friday.

Within the third week of July, the expectation of low provide ranges within the coming months exerted an upward affect on Brent oil futures costs. Rising tensions between Russia and Ukraine and the announcement of measures to spice up financial progress in China additionally contributed to the worth improve. Alternatively, within the fourth week of July, the potential improve in rates of interest in the US and the European Union might have a decrease affect on costs.

On the subject of TTF fuel ICE market futures costs for Entrance‑Month, on Monday, July 17, they continued the downward development of the earlier week and the weekly minimal settlement worth of €25.10/MWh was registered. This worth is 17% decrease than final Monday and the bottom since June 6. However most periods within the third week of July registered worth will increase. Because of this, on Friday, July 21, the weekly most settlement worth of €28.85/MWh was reached. This worth is 11% greater than final Friday. Nonetheless, the common for the third week of July was 1.8% decrease than the earlier week.

The rise in demand for electrical energy manufacturing, on account of excessive temperatures and discount in wind power manufacturing, has had its upward affect on TTF futures costs within the third week of July. Nonetheless, reserve ranges in Europe are excessive and fuel provide from Norway has elevated following upkeep.

About Co2 emission rights way forward for EEX market for the reference contract of December 2023, on Monday, July 17, the weekly minimal settlement worth, of €86.49/t, was registered, which was 0.2% greater than the earlier Monday. Within the third week of July, futures costs registered an upward development. Because of this, on Friday, July 21, the weekly most settlement worth of €91.43/t was reached. This worth is 6.3% greater than final Friday and the very best because the fourth week of June. Expectations of a low provide in August auctions exerted an upward affect on costs within the third week of July.

The views and opinions expressed on this article are these of the writer, and don’t essentially replicate these held by pv journal.

This content material is protected by copyright and is probably not reused. If you wish to cooperate with us and wish to reuse a few of our content material, please contact: [email protected].

[ad_2]

Source link