[ad_1]

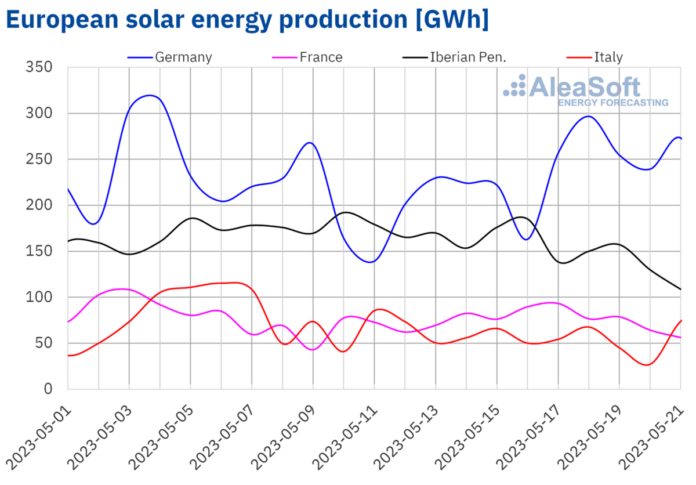

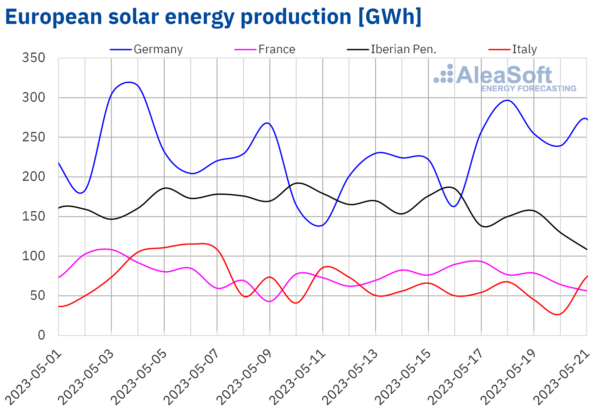

Within the week of Might 15, the 20th week of the 12 months, photo voltaic photovoltaic vitality manufacturing reached a report worth within the Iberian Peninsula, with a complete manufacturing of 862 GWh in Spain and 81 GWh in Portugal, in comparison with the twentieth that week. within the final 5 years. Nevertheless, in comparison with final week, when historic information have been registered in these two markets, the manufacturing of photo voltaic vitality, together with the manufacturing of photo voltaic thermoelectric vitality within the case of Spain, fell by 13% and 16% each. The identical development was noticed in Italy, with a lower of 11% in comparison with the week of Might 8. Within the remaining markets analyzed by AleaSoft Vitality Forecasting, A rise in photo voltaic vitality manufacturing of 12% and 17% was registered in France and Germany, respectively.

For the week of Might 22, AleaSoft Vitality Forecasting’s photo voltaic vitality manufacturing forecasting reveals that manufacturing will improve in Germany and Italy, however it could fall in Spain.

Picture: Aleasoft Vitality Forecasting

Picture: Aleasoft Vitality Forecasting

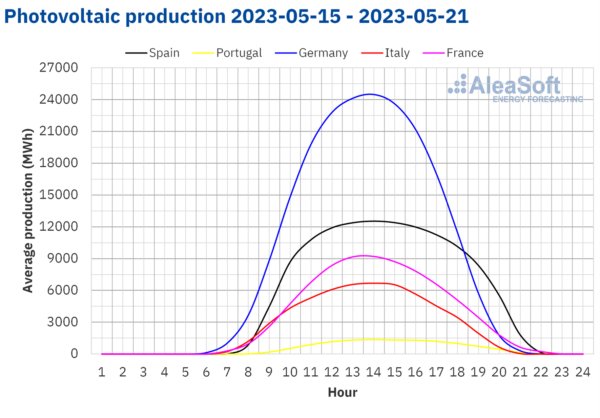

Within the third week of Might, much like photo voltaic photovoltaic vitality manufacturing, wind vitality manufacturing set a report within the Iberian Peninsula, with a complete quantity of 1,830 GWh in Spain and 326 GWh in Portugal, in comparison with the twentieth week previously 5 years. In comparison with final week, a rise in virtually all analyzed markets was registered, between 31% in Germany and 51% in France. Within the Spanish and Italian markets, the manufacturing of this expertise additionally elevated, with 37% in Spain and 39% in Italy. Nevertheless, in Portugal, a drop of 6.9% was registered.

For the present week, AleaSoft Vitality Forecasting’s wind vitality manufacturing forecasting reveals that manufacturing could fall in all analyzed markets.

Picture: Aleasoft Vitality Forecasting

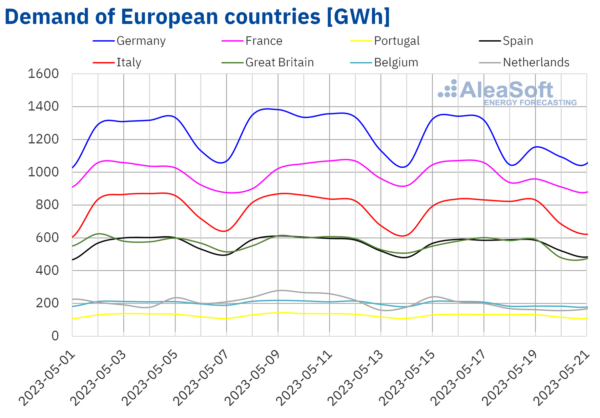

Electrical energy demand

The third week of Might ended with a drop in electrical energy demand in all European markets analyzed in comparison with the earlier week. This conduct is said to the celebration of Ascension Day on Might 18 in lots of essential European markets. The largest fall, of 18%, was noticed within the Netherlands. However, the smallest lower was registered in Italy, by 1.4%, and in Spain, with a drop of 1.7%. In these two markets, the day of Might 18 isn’t a vacation.

In regards to the common temperature, Decreases have been registered in comparison with final week in virtually all analyzed markets, apart from Nice Britain and Italy, the place they remained the identical as final week.

For the week of Might 22, based on the demand forecast made by AleaSoft Vitality Forecastingdemand is anticipated to extend in all main European markets besides Spain and Nice Britain.

Picture: Aleasoft Vitality Forecasting

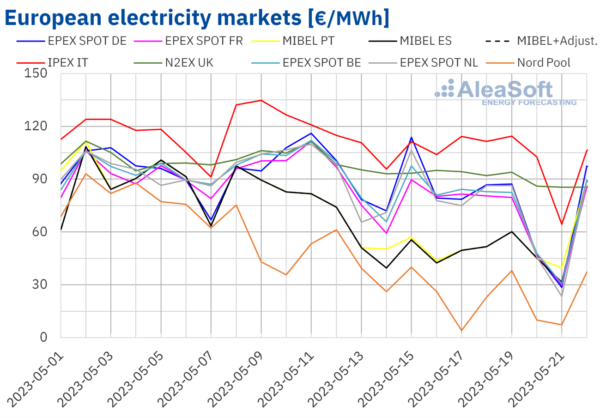

European electrical energy markets

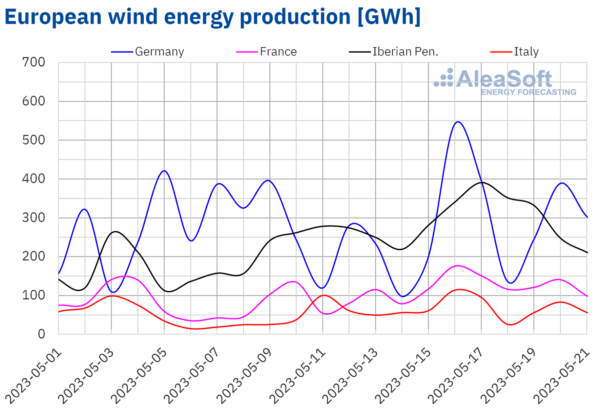

Within the week of Might 15, costs in all European electrical energy markets decreased in comparison with the earlier week. The largest fall, 56%, was registered within the Nord Pool market within the Nordic international locations. However, the smallest worth lower, 9.9%, was within the N2EX market in the UK. Within the remaining markets, the discount is between 14% within the IPEX market in Italy and 35% within the MIBEL market in Spain.

Within the second week of Might, the best common worth, €103.21 ($111.63)/MWh, was within the Italian market, adopted by the typical within the N2EX market in the UK, which was €91.46/MWh. However, the bottom weekly common worth is that of the Nordic market, €21.23/MWh. In different markets, costs are set between €48.07/MWh within the Spanish market and €74.43/MWh within the EPEX SPOT market in Germany.

Relating to hourly costs, within the Spanish market, on Sunday, Might 21, a zero-price worth was registered between 10:00 and 11:00. Within the German, Belgian, French, and Dutch markets, other than zero-price hours, damaging costs have been registered on the weekend of Might 20 and 21. This additionally occurred on Wednesday, Might 17, within the Netherlands. Within the case of the Nordic market, damaging costs have been registered for the times of Might 20 and 21. On this market, a historic minimal, no less than since 2011, of –€5.67/MWh was reached on Sunday , Might 21, between 13: 00 and 14:00. However, the bottom hourly worth within the third week of Might, ‑€76.00/MWh, was registered on the identical day, from 12:00 to 13:00, within the Dutch market.

In the course of the week of Might 15, the lower within the common worth of fuel and the final lower in demand led to a lower within the worth of electrical energy markets in Europe. These drops have been additionally affected by the rise in wind vitality manufacturing in most markets and the rise in photo voltaic vitality manufacturing in France and Germany.

The worth forecast of AleaSoft Vitality Forecasting reveals that, within the fourth week of Might, costs could improve in most European electrical energy markets, influenced by the restoration of demand and the discount of wind vitality manufacturing.

Picture: Aleasoft Vitality Forecasting

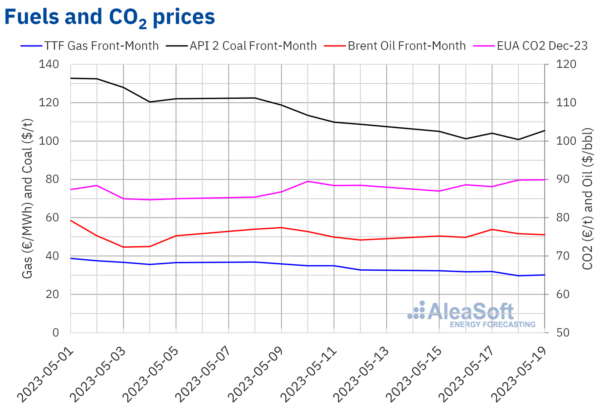

Brent, gasoline, and CO2

Brent oil futures for Entrance‑Month on the ICE market registered their weekly minimal settlement worth of $74.91/bbl on Tuesday, Might 16. This worth is 3.3% decrease than final Tuesday. However costs rose on Wednesday, Might 17, and the weekly most settlement worth of $76.96/bbl was reached, which was 0.7% greater than final Wednesday. Subsequently, costs decreased till a settlement worth of $75.58/bbl was registered on Friday, Might 19. This worth was 1.9% greater than the earlier Friday.

US debt ceiling negotiations influenced Brent futures costs within the third week of Might. However, the worry of additional rate of interest hikes as a result of stage of inflation within the US and its affect on demand has exerted a downward affect on costs. The discharge of information on the rise in oil shares in the US additionally contributed to this impact.

As for TTF fuel futures on the ICE marketplace for the Entrance‑Month, on Monday, Might 15, they reached the weekly most settlement worth of €32.31/MWh, though this worth is decrease by 12% than final Monday. In the course of the third week of Might, the settlement costs have been decrease than the identical days of the earlier week. On Thursday, Might 18, the weekly minimal settlement worth of €29.78/MWh was reached. This worth is 15% decrease than final Thursday and the bottom since June 2021.

Within the third week of Might, the abundance of liquefied pure fuel provide in a situation the place demand has decreased, continues to push costs.

About CO2 emission rights futures market EEX for the reference contract of December 2023, on Monday, Might 15, they decreased 1.7% in comparison with the final session final week. On that day, the weekly minimal settlement worth of €86.97/t was reached. Nevertheless, later, costs elevated and so they remained above €88/t for the remainder of the third week of Might. On Friday, Might 19, the weekly most settlement worth of €89.88/t was reached, which was 1.6% greater than the earlier Friday and the best since April 20.

Picture: Aleasoft Vitality Forecasting

On June 8 would be the version quantity 34 of the month-to-month webinar of AleaSoft Vitality Forecasting and AleaGreen. This version will see the participation of audio system from Engie Spain once more, who will analyze the basics of financing renewable vitality initiatives and PPAs in addition to the primary regulatory problems with electrical energy sector in Spain, based mostly on their expertise in these areas. As well as, the same old evaluation of the evolution and prospects of the European vitality markets shall be carried out, with a view to the second half of 2023 and the approaching winter.

The views and opinions expressed on this article are these of the creator, and don’t essentially replicate these held by pv journal.

This content material is protected by copyright and will not be reused. If you wish to cooperate with us and wish to reuse a few of our content material, please contact: [email protected].

[ad_2]

Source link