[ad_1]

From pv journal 06/23

Two of the biggest photo voltaic markets, america and China, are increasing their distributed era capability by greater than 65% in 2021 and 2022, towards a 4% fall and an 18% rebound on the utility scale. PV. Meaning a qualitative shift in financing, particularly in supporting the mixing of mass, networked, distributed-energy assets (DER) below digital energy vegetation (VPPs) and conventional utilities. Rethink Expertise Analysis believes that utilities, particularly in america, are planning to take part within the mass distributed-solar rollout. We consider they may provide to accomplice with residential and industrial and industrial (C&I) house owners and act as a financing bridge.

Whereas internet metering funds and decreased electrical energy gross sales might scare utilities, energy corporations have massive steadiness sheets to leverage and may recruit “full scale” distributed clients. apod-generation (DG), geared up with their highest photo voltaic roof and power storage potential.

First mover

The primary energy firm to embrace this variation shall be adopted by others as a result of the choice is to desert clients who’re rich sufficient to go full-scale distributed alone, with out depend on the grid. Utilities that lease rooftops again to clients who cannot purchase PV arrays straight open up the market to extra photo voltaic clients and shield themselves from falling power costs whereas sustaining management. to generate electrical energy.

With half of the world’s electrical energy coming from photo voltaic sooner or later – and half from DG arrays – utilities might want to embrace VPPs that are anticipated to change into widespread within the US within the subsequent two years, and later in Australia, approx. a part of Europe, and , probably sturdy DER markets resembling Japan.

VPP view

The Rocky Mountain Institute, a sustainability thinktank, introduced a digital energy plant partnership in January with Basic Motors. It additionally introduced agreements with Ford, Sunpower, Sunrun, home-automation specialist Google Nest, and the OhmConnect energy-efficiency program. As well as, it started working with Olivine, a specialist in power demand response, and SPAN, which offers panels for residence power consumption. It additionally companions with VPP developer SwitchDin and Digital Peaker, a residential electrical demand software program platform.

Utilities in america and elsewhere are actually required to allow VPPs on their grids, that means they need to observe and mannequin VPP grid participation. Greater than two-thirds of electrical energy meters within the US by the tip of 2021 shall be good gadgets, with 120 million already put in.

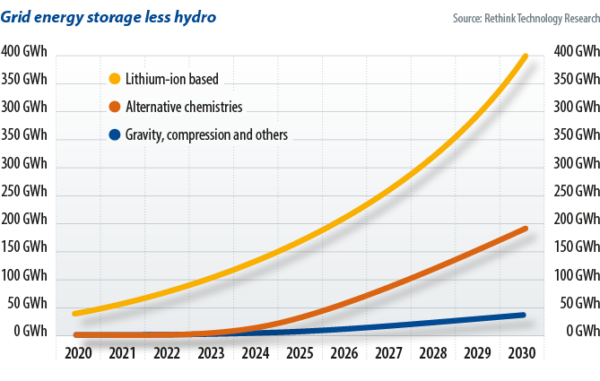

Impartial aggregators are actually pushing VPPs, that means extra era and storage is taken out of the utilities’ fingers till they be part of the market. If greater than 60% of the photo voltaic capability is small, an equal quantity of storage capability will be anticipated, paid for by the owners or whoever pays for the methods, and included in a VPP that we may give.

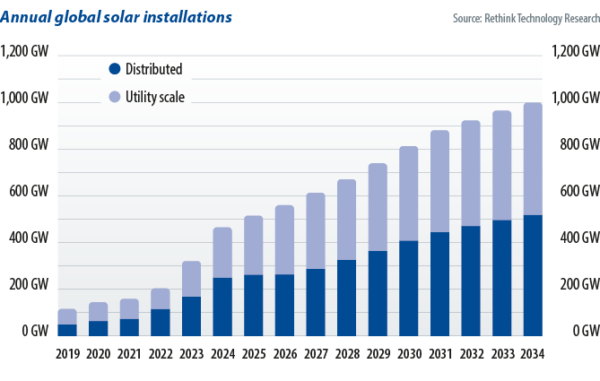

Regardless of rising photo voltaic costs, Rethink Vitality estimates that the worldwide PV trade grew by 30% final yr, with 221 GW added, and can improve by 50% this yr and in 2024, based mostly on 330 GW of annual photo voltaic manufacturing capability final yr, plus 45 GW per yr. month this yr.

Distributed view

We estimate that rooftop panels accounted for 57% of photo voltaic added final yr and can stay above 50% till mid-2025, with DG numbers rising within the US, China, and most different massive markets. Whereas excessive module costs and different provide chain points have affected utility-scale vegetation, the struggle in Ukraine is prompting individuals and companies to show to photo voltaic to guard power safety.

Rethink Vitality expects the pendulum to swing again to the utility from 2025 to 2030, as manufacturing bottlenecks and module costs – which make up round 40% of venture prices – return to the curve of worth declines. prevailed till mid-2020. Costs topped $300 per kilowatt of era capability in late 2021 however have now fallen beneath $240/kW, earlier than supply, and can attain $200/kW in 2025.

DG methods will take the crown from 2031, to hit 63% of all new installations in 2050. Each will growth and whereas a whole bunch of gigawatts of capability within the deserts of Australia and Chile alone will present inexperienced hydrogen energy, the potential of DG shall be better, pushed by power costs.

Distributed photo voltaic has so many price components that the rise within the worth of polysilicon – which nonetheless accounts for greater than 25% of module prices – hardly adjustments the monetary method, which makes of small PV will dominate. Many nations are selling rooftop photo voltaic with new insurance policies however that is merely driving the wave, not inflicting it.

By 2027, utility-scale photo voltaic will, briefly, as soon as once more benefit from the 57% share of latest installations it did earlier than the pandemic. From that time, a number of long-term developments will work in favor of distributed PV – considered one of which is the “subsequent large limiting issue” within the photo voltaic trade – transmission. In 2031, the 2 sectors will return to parity, as distribution prepares to take a second likelihood.

In regards to the creator: Peter White based Computerwire in 1984, launching tech publications resembling “Laptop Enterprise Evaluation” earlier than evolving right into a market analysis and consulting agency. White based Rethink Expertise Analysis in 2002 to publish technique bulletins and market forecasts. The corporate has a expertise focus in video, cable, satellite tv for pc, and digital properties, together with photo voltaic, power storage, hydrogen, and wind energy.

The views and opinions expressed on this article are these of the creator, and don’t essentially replicate these held by pv journal.

This content material is protected by copyright and will not be reused. If you wish to cooperate with us and need to reuse a few of our content material, please contact: [email protected].

[ad_2]

Source link