[ad_1]

Photo voltaic corporations are getting a number of consideration in 2022 as rising oil and gasoline costs reinforce the necessity to swap to renewable vitality sources. As well as, vital tax credit below the Inflation Discount Act, handed in August 2022, are anticipated to speed up the adoption of photo voltaic vitality. Towards this favorable demand backdrop, we used TipRanks’ Inventory Comparability Software to put Enphase Vitality (NASDAQ:ENPH), Sunrun (NASDAQ: RUN), and First Photo voltaic (NASDAQ: FSLR) towards one another to select essentially the most enticing photo voltaic shares like Wall Avenue execs.

Enphase Vitality (NASDAQ:ENPH)

Enphase and SolarEdge Applied sciences (SEDG) holds a duopoly within the US residential photo voltaic inverter market. Enphase manufactures microinverters that convert direct present (DC) generated by a photo voltaic module into alternating present (AC).

Enphase is rising strongly, with Q3 2022 efficiency exhibiting sturdy demand developments. The corporate’s Q3 income rose almost 81% year-over-year to $634.7 million and adjusted EPS surged 108% to $1.25. Along with North America, the corporate skilled spectacular development in Europe, supported by stable demand for its merchandise within the Netherlands, France, Germany, Belgium, Spain, and Portugal.

Is Enphase a Purchase, Maintain, or Promote?

Not too long ago, Daiwa Securities analyst Jonathan Kees initiated protection on Enphase Vitality with a Purchase score and a value goal of $335, based mostly on an Enterprise Worth (EV)/adjusted 2023 EBITDA a number of of 49x. Kees famous that his goal a number of is roughly in step with the “2.1 12 months common of fifty.4x/, which makes the danger/reward extra acceptable.”

Kees emphasised that Enphase has received market share in a duopoly, gives the very best margins, and stays “the main microinverter tech firm.” As well as, the corporate is increasing past the US, doubling its presence in Europe yearly for the previous two years.

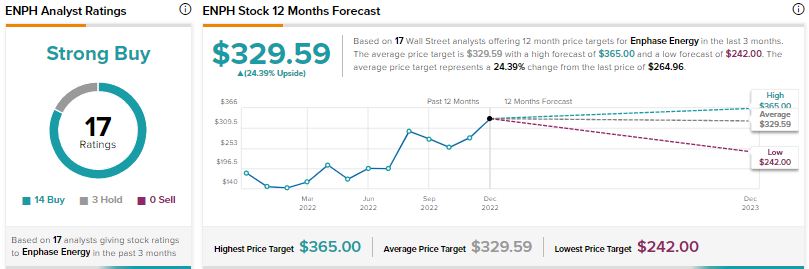

Wall Avenue’s Sturdy Purchase consensus score for Enphase inventory is predicated on 14 Buys and three Holds. ENPH’s common inventory value goal of $329.59 implies a 24.4% upside potential. Shares have rallied almost 45% in 2022.

Sunrun (NASDAQ:RUN)

Sunrun is without doubt one of the main gamers within the residential photo voltaic market. As of September 30, 2022, Sunrun had 759,937 clients, exhibiting a 21% year-over-year development. The corporate impressed buyers with a 44% improve in income in Q3 2022 to 1.9 million. Q3 earnings per share (EPS) jumped sharply to $0.96 from $0.11 within the year-ago quarter, as a result of firm’s pricing energy and robust demand.

Put in photo voltaic vitality capability elevated by 17% to 256 megawatts in Q3 2022 and the corporate is guiding for about 25% development in full-year (2022) capability. Whereas Sunrun’s debt degree is excessive, it’s nicely positioned to satisfy its obligations and develop additional to seize alternatives within the photo voltaic vitality market.

Is Sunrun a Good Inventory to Purchase Now?

Not too long ago, Susquehanna analyst Biju Perincheril barely raised his value goal for Sunrun inventory to $42 from $41 and reiterated a Purchase score.

Sunrun scored a Sturdy Purchase consensus score based mostly on 12 Buys and two Holds. Common RUN inventory goal value of $46.93 implies 95.4% upside potential. Analysts see the inventory’s 30% plunge in 2022 as a pretty alternative to construct a long-term place.

First Photo voltaic (NASDAQ:FSLR)

First Photo voltaic inventory had a stellar rally final 12 months as the corporate was seen as a significant beneficiary of the Inflation Discount Act. The US-based photo voltaic modules maker reported a bigger-than-expected loss in Q3 2022 and lowered its full-year revenue steerage, citing excessive logistics prices. Nonetheless, most analysts overlaying FSLR inventory stay optimistic concerning the firm’s development potential.

First Photo voltaic appears to be nicely positioned for development within the coming years, as a result of a powerful backlog of future deliveries of 58.1 gigawatts, which incorporates orders for supply scheduled till 2027. The corporate is investing as much as .2 billion to extend home manufacturing of photovoltaic (PV) photo voltaic modules to greater than 10 gigawatts DC (GWDC) by 2025. As a part of this plan, First Photo voltaic is investing about .1 billion to construct the fourth manufacturing facility based mostly within the US in Alabama, which is anticipated to be commissioned in 2025 and has an annual capability of three.5 GWDC.

What’s the Worth Goal for First Photo voltaic?

Moreover Enphase, Kees additionally initiated protection on First Photo voltaic inventory with a Purchase score and a goal value of $175, based mostly on an Enterprise Worth (EV)/2023 EBITDA a number of of 20x. Kees identified that the goal a number of is decrease than the “2.1 12 months common of 25.7x,” which makes FSLR’s danger/reward profile extra acceptable with expectations that EBITDA will rise from the 2022 low. The analyst feels that the Avenue is probably not totally contemplating the anticipated rebound in ahead estimates.

Total, the Avenue’s Average Purchase consensus score for First Photo voltaic inventory is predicated on 12 Buys and 5 Holds. At $182.13, the inventory’s common value goal suggests 21.6% upside potential. FSLR inventory is up almost 72% in 2022.

Conclusion

The long-term prospects for all three of those photo voltaic corporations look enticing, given the rising demand for photo voltaic vitality and the advantages below the Inflation Discount Act. Whereas Enphase and First Photo voltaic shares outperform Sunrun in 2022, Wall Avenue sees greater upside potential in Sunrun inventory in 2023 after final 12 months’s pullback.

disclosures

[ad_2]

Source link