[ad_1]

Justin Paget

Canadian Photo voltaic Is An Unfollowed Chief In One Of The Quickest Rising Industries

Canadian Photo voltaic Inc. (NASDAQ:CSIQ) is without doubt one of the largest solar energy firms on this planet, with a market cap of ~$2.7 billion and rising. The corporate, headquartered in Canada, is a main vertically-integrated supplier of photo voltaic vitality options, with a various portfolio of merchandise focusing on the utility and business & industrial solar energy markets. The corporate is without doubt one of the few photo voltaic producers that’s vertically built-in, which means it operates throughout the whole photo voltaic product growth worth chain, from ingots and wafers to cells, modules, and full gadgets. system (Determine 1).

This provides Canadian Photo voltaic a value benefit over its opponents, in addition to a greater understanding of end-market necessities for its merchandise. The corporate can be a number one supplier of photo voltaic vitality options, with a variety portfolio of merchandise focusing on the utility and business and industrial solar energy markets. As well as, Canadian Photo voltaic has a powerful dedication to ESG (environmental, social, and governance) requirements, that are mirrored in its business management. continuity marks. All of those components make Canadian Photo voltaic a beautiful funding at present low cost ranges.

CSIQ Merchandise Web page

Determine 1. Canadian Photo voltaic presents a variety of photo voltaic merchandise, from modules to inverters to finish techniques and even vitality storage options.

The corporate’s shares have rallied over the previous yr greater than 66%. Nonetheless, Canadian Photo voltaic’s inventory value remains to be buying and selling at a reduced valuation. Given the corporate’s sturdy development prospects, massive operations, and various buyer base, we consider Canadian Photo voltaic inventory is a stable purchase at present ranges and will supply as much as 50% extra long-term enhance conservatively. The corporate can be a pacesetter within the quickly rising photo voltaic vitality storage market and is properly positioned to profit from the growing demand for renewable vitality.

Present Pricing

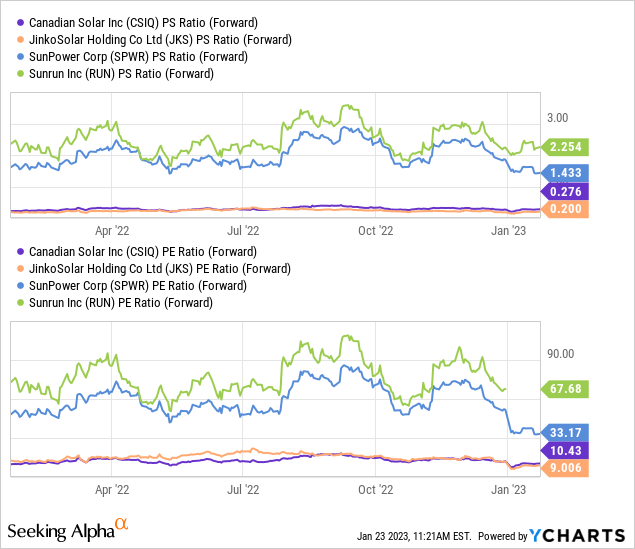

On January 24, 2022, the inventory of Canadian Photo voltaic Inc. traded at round $43 per share. This provides the corporate a Worth to Earnings ratio of ~16.7x earnings, a value to gross sales ratio of 0.4x earnings, and an EV to sale ratio of ~0.64x gross sales (Determine 2). On common, the corporate trades at roughly a 60% low cost to opponents based on these values. Solely JinkoSolar (JKS) is buying and selling at a aggressive valuation degree, and we choose Canadian Photo voltaic over Jinko due to the fixed uncertainty that China-headquartered investments carry.

Determine 2. Canadian photo voltaic trades in half of most photo voltaic firms, minus Jinko Photo voltaic, a Chinese language powerhouse.

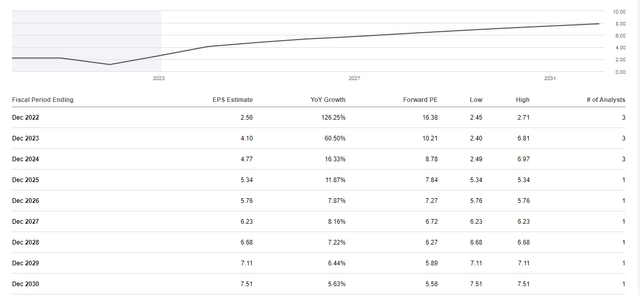

Wall Avenue analysts consider sturdy earnings and income development are on the horizon for CSIQ, making a reduced inventory doubtlessly even cheaper going ahead if the corporate hits estimates (Determine 3). Due to this fact, we consider that because the inventory trades at a median low cost of ~ 59% decrease than the competitors primarily based on important valuation metrics, and that the expansion is anticipated to exceed friends, that for within the close to future, 60% upside shall be conservative ultimately. in 2024.

SA CSIQ Income Estimates

Determine 3. Canadian photo voltaic is anticipated to develop many instances over quicker than opponents over the subsequent 2-3 years in EPS and earnings.

Extra catalysts, reminiscent of a world shift to inexperienced vitality stipend by way of investments from governments world wide (Canadian Photo voltaic could be present in over 23 nations throughout 6 continents), will solely present extra tailwind and permit for doubtlessly greater returns as markets slowly return to regular.

Dangers

Canadian Photo voltaic has been in enterprise for over 20 years and is headquartered in Canada, giving them a wealth of expertise in a comparatively new discipline of expertise. Whereas Canadian Photo voltaic inventory has rallied lately, up greater than 175% since 2018, there are a number of dangers that traders ought to pay attention to earlier than contemplating an funding. First, the photo voltaic business has been notoriously cyclical up to now and has relied closely on authorities subsidies and incentives to stay aggressive with pure fuel and oil. If these subsidies are diminished or eradicated, as has occurred in lots of nations lately with the elections of recent leaders with completely different political and financial views, the inventory of Canadian Photo voltaic seemingly hit (2015/2016).

Second, the corporate has a considerable amount of debt, which stands at round $2.6 billion. This debt load may very well be an issue if the photo voltaic market weakens and Canadian Photo voltaic is unable to refinance its debt and ship on market development. With over $1B of money available proper now, we do not see this as a serious challenge, nevertheless it ought to be monitored from quarter to quarter.

Lastly, the photo voltaic business is very aggressive, and Canadian Photo voltaic faces stiff competitors from different firms, reminiscent of First Photo voltaic ( FSLR ) and SunPower ( SPWR ). We consider that the general market share of photo voltaic in comparison with different types of vitality is rising at a tempo that may permit most photo voltaic opponents to develop alongside CSIQ and this doesn’t seem like a serious challenge for within the close to future.

General, there seems to be a reasonably stable degree of help across the $30 degree, and we do not see the CSIQ melting under it until main detrimental information breaks. This is able to point out ~30% potential draw back, giving the inventory a 2:1 upside to draw back ratio in our opinion, which is a compelling funding proposition out of any inventory.

Common Funding Abstract

In conclusion, Canadian Photo voltaic Inc. a inventory price contemplating for funding in 2023. Discounted valuations and tailwinds from ESG and authorities help ought to assist push the inventory greater. We consider even after the current rally there could also be as much as 60% long run left in Canadian Photo voltaic inventory. Canadian Photo voltaic Inc. has a powerful stability sheet, sturdy profitability historical past, and a various portfolio of merchandise and geographies. With round 30% draw back danger in our view, Canadian Photo voltaic inventory deserves a powerful search for traders in search of a photo voltaic play in 2023-24. Rivals are buying and selling at greater costs regardless of lackluster development anticipated within the coming years, in contrast to Canadian Photo voltaic Inc.

[ad_2]

Source link