[ad_1]

Within the new weekly replace for pv journalOPIS, a Dow Jones firm, offers a fast overview of the principle worth developments within the international PV business.

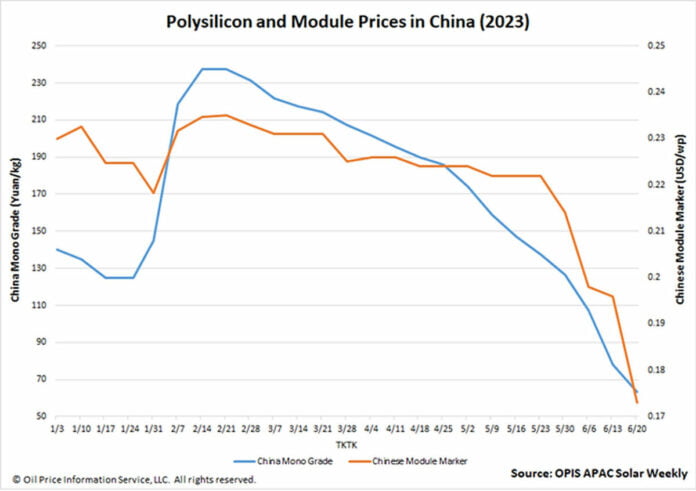

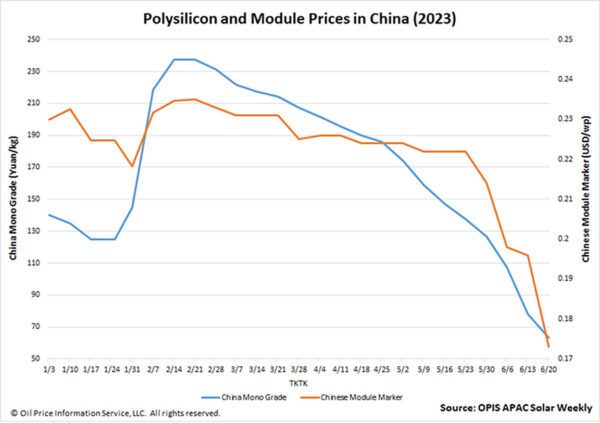

The Chinese language Module Marker (CMM), OPIS’ benchmark evaluation for modules from China, dived to $0.173 per W, falling for the fourth week working to the bottom worth since OPIS knowledge. After Intersolar Europe, the market ought to think about that there are clear indicators that the area is oversupplied with modules, in addition to how Chinese language polysilicon costs are very near their ground.

The 11.73% week-over-week decline can be CMM’s record-breaking largest share decline ever.

It comes as OPIS contacts, throughout and since Intersolar, have virtually unanimously emphasised that costs are falling quick and arduous. Most have seen costs within the $0.170-0.175/W vary, with numbers as little as $0.150/W heard. Others do not share costs as they test the extent of decline.

Together with the identical unity, the market gamers additionally bemoaned the overstock of module inventories in Europe, which is going through a lower in values and proscribing additional shipments. Europe will set up a document 46.1 GW of solar energy in 2022, based on a report by SolarPower Europe. However about 85 GW of modules had been shipped there final 12 months, with the remainder ending up in warehouses owned by Chinese language corporations throughout Europe, based on a veteran market watcher.

Since these modules signify in 2022 a lot increased than present costs, it’s higher to promote them now, earlier than the costs drop and the businesses danger extra losses, added the veteran.

A continent away from Europe, China’s polysilicon costs fell to CNY63.5 ($8.84)/kg, on the threshold of CNY60/kg. materials worth. It’s a “frequent consensus” that this market is at present going through extra capability, stated a supply, who added that tier-1 producers in China alone have greater than 100,000 MT of polysilicon stockpiled.

Wanting forward and in gentle of those bearish components, module costs are anticipated to proceed to slip, with one supply anticipating them to stabilize within the subsequent quarter after polysilicon and wafer elements hit their money value.

The views and opinions expressed on this article are these of the writer, and don’t essentially replicate these held by pv journal.

This content material is protected by copyright and is probably not reused. If you wish to cooperate with us and need to reuse a few of our content material, please contact: [email protected].

[ad_2]

Source link