After an interim excessive in 2021, China’s polysilicon imports will even fall in 2022, however the nation’s share of world output remains to be near 90%, in line with a brand new report by Bernreuter Analysis.

China’s imports of polysilicon fell 23% year-on-year to 88,093 metric tons (MT) in 2022, because of the rise of latest manufacturing capability within the nation, in line with a brand new report by Bernreuter Analysis. The reductions observe a extreme scarcity of polysilicon in 2021.

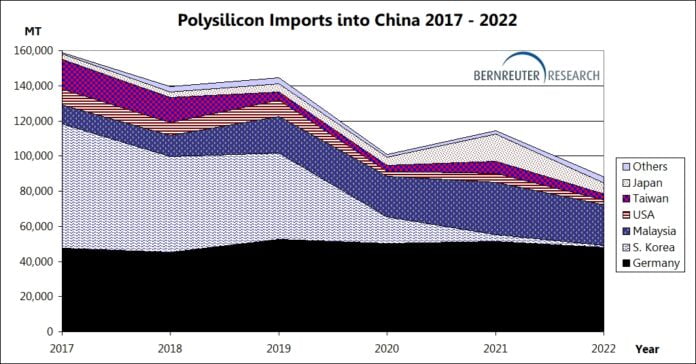

China’s annual polysilicon imports have nearly halved from their peak of 158,918 MT in 2017. They’re now near the extent of 2012, once they reached 82,760 MT.

The most important decline was seen in imports from Japan. In 2021, Sharp offloaded massive volumes of polysilicon stock after the corporate’s long-term buy contract with Hemlock Semiconductor expired in 2020. That introduced imports from Japan to a document excessive of 15,431 MT in 2021. Nonetheless, in 2022, imports fell by 60 % to six,129 MT.

An analogous improvement occurred in Taiwan, the place former producers of photo voltaic wafers are nonetheless promoting polysilicon shares they personal from long-term contracts to China. Imports from Taiwan decreased by 50% from 6,899 MT in 2021 to three,480 MT in 2022.

The Malaysian polysilicon subsidiary of South Korean chemical substances group OCI additionally exports much less to China. Its cargo quantity fell 23% from 29,727 MT to 22,944 MT, as a result of greater than anticipated upkeep work on the OCI manufacturing unit.

Imports from Germany’s Wacker, China’s largest overseas polysilicon provider, fell 6.3% from 51,316 MT to 48,070 MT. US-based Hemlock Semiconductor lowered its volumes from 4,811 MT to 2,785 MT, as polysilicon producers terminated gross sales contracts with Chinese language module maker JinkoSolar, opening a brand new wafer manufacturing unit with a 7 GW wafer facility in Vietnam in early 2022.

Trina Photo voltaic is the subsequent main Chinese language module maker to maneuver manufacturing in response to ongoing anti-dumping and countervailing obligation investigations in america. Trina is anticipated to open a 6.5 GW wafer manufacturing facility in Vietnam by mid-2023.

“With the Uyghur Compelled Labor Prevention Act banning merchandise from Xinjiang and the anti-circumvention ruling in opposition to photo voltaic modules made with Chinese language wafers in Southeast Asia, america is pushing the demand for photo voltaic panels made in polysilicon and wafers that aren’t from China,” mentioned Bernreuter Analysis. “On the identical time, China’s polysilicon imports will additional lower as a result of massive home capability growth. Consequently, the way forward for non-Chinese language polysilicon feedstock lies outdoors of China.

Preliminary manufacturing estimates present China’s share of world solar-grade polysilicon output at 88% in 2022, up from 82% in 2021 and 55% in 2017. As a result of massive good points seen in 2022, analysts the trade expects the present polysilicon growth initiatives to be realized in 2023, with manufacturing quickly growing to a ultimate surplus.

This content material is protected by copyright and is probably not reused. If you wish to cooperate with us and need to reuse a few of our content material, please contact: [email protected].