By BEN COOK

- Regulation corporations are creating experience in financial savings mergers and SPACs

- White & Case, Latham & Watkins and Norton Rose featured prominently

- The US and UK financial savings markets have seen many new offers

As power storage is more and more acknowledged by traders as an asset class in its personal proper, legislation corporations need to set up themselves as consultants on this fast-growing sector.

Due to this, many corporations have developed a track-record as specialists within the subject.

Along with recommendation on share choices and mergers and acquisitions, the agency has lately suggested corporations on mixtures of particular goal acquisition corporations (SPACs) with the intention of turning into listed on public.

Which corporations advise on excessive profile issues?

Regulation corporations White and Case, Latham and Watkinsand Norton Rose Fulbright one of the high-profile advisers on latest power storage offers.

Legal professionals from New York and the Texas metropolis of Houston (Texas is acknowledged as having one of many quickest rising financial savings markets within the US) have been skilled in giant transactions of late. In the meantime, many well-known offers within the UK and particularly, Scotland, have created work for corporations similar to Burgess Salmon and TLT.

Final month, White & Case LLP suggested Ormat Applied sciencesa geothermal, power storage, photo voltaic PV and recovered power energy firm, in an upsized US$338 million providing of frequent inventory to its stockholders, ORIX Company. The White & Case staff advising on the transaction was led by capital markets companions Colin Diamond(primarily based in New York/Houston) and AJ Ericksen (Houston).

A Houston-based legal professional can also be main the Latham and Watkins advisory staff Terra-Gen to promote an 80% curiosity within the Edwards Sanborn 1A co-located photo voltaic plus storage facility to an “affiliate” of Axium Infrastructure. The Latham staff is led by a Houston companion Lauren Anderson.

Bother with UK offers

In the meantime, there was vital exercise within the UK market of late and legal professionals with experience in power storage are in demand. Final month, Norton Rose Fulbright suggested Gore Avenue Power Storage Fund (GSEF), the primary inventory market-listed storage fund in London, to amass a portfolio of 81MW of UK battery storage property. The Norton Rose staff is led by a London-based company companion Stephen Rigby.

Elsewhere, Burgess Salmon suggested Engie on its acquisition of a completely permitted 50 MW battery storage website in southern Scotland from a three way partnership involving ILI Group, Abbey Group, and YOO Power. The Burges Salmon staff advising on the deal was led by the Edinburgh-based company companion Danny Lee. Moreover, Burges Salmon additionally suggested Kona Power on the sale of its upcoming 200MW battery storage facility to the Gore Avenue Power Storage Fund (GSEF). The mission is situated in Heysham, Lancashire, and represents GSEF’s largest acquisition up to now. The Burges Salmon staff advising on the deal was led by companion Camilla Usher-Clark.

In one other deal in Scotland, legislation agency TLT suggested Clever Land Investments Group (ILI) in finishing the sale of the 50MW battery storage mission to TagEnergy. The TLT staff advising on the mission – which is able to connect with the grid in 2024 – is led by company companion Damien Bechelli.

Again in October, pan-European legislation agency ADVANT Beiten suggested Stuttgart-headquartered TransnetBW on the award, negotiation and conclusion of mission agreements with Fluence Power for the development of a 250MW battery storage facility in Kupferzell, Germany. The ADVANT Beiten staff contains the power companion and Hamburg workplace head Dr. Christian Ulrich Wolf.

SPACs have confirmed fashionable

Some examples of notable storage-related issues for legislation corporations are later included White and Case suggested Tigo Power, a supplier of photo voltaic and power storage methods, within the mixture with Roth CH Acquisition IV Co. a public firm. FOR Piper LLP and Loeb and Loeb LLPacted as authorized counsel to Roth.

In the meantime, Ellenoff Grossman & Schole LLP suggested Electriq Energy, an power storage supplier for properties and small companies, in a merger with TLG Acquisition One Corp (TLGA), a publicly traded SPAC. Gibson, Dunn and Crutcher acted as authorized counsel to TLGA.

Because the power storage sector grows, trade transactions develop into extra subtle. There are a number of legislation corporations which can be quickly creating their experience on this subject and have established themselves as market leaders within the sector.

Regardless of the fierce competitors amongst legislation corporations, with many giant offers anticipated within the close to future we are able to anticipate some key gamers to strengthen their management place within the rising market of storage.

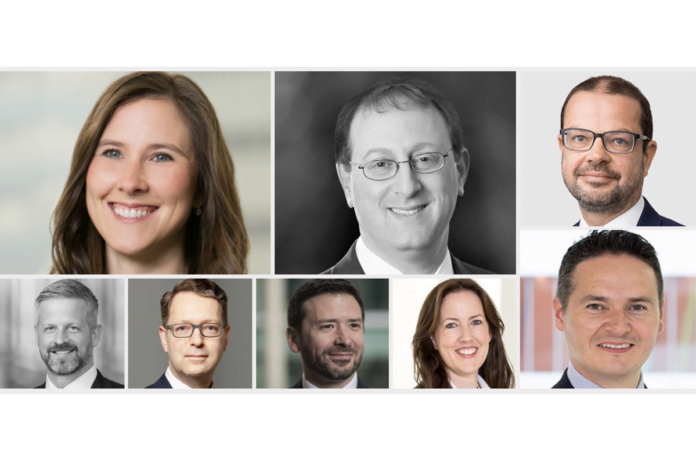

PICTURE (clockwise from the highest left): Lauren Anderson (Latham & Watkins); Colin Diamond (White and Case); Stephen Rigby (Norton Rose Fulbright); Danny Lee (Burges Salmon); Camilla Usher-Clark (Burges Salmon); Damien Bechelli (TLT); Dr Christian Ulrich Wolf (ADVANT Beiten); OTHERS AJ Ericksen (White and Case).