With growing capital commitments, there may be now a shift to minority investments and rising expertise subsectors. pv journal evaluated M&A views supplied by CohnReznick Capital and FTI Consulting.

From pv journal USA

CohnReznick Capital Markets shared that the 2o23 US renewable vitality market is anticipated to be outlined by the juxtaposition of great momentum from latest adjustments in US coverage and uncertainty arising from turmoil in world markets.

Because the Worldwide Vitality Company expects 2,400 GW of renewables to return on-line by 2027, the world will add as a lot renewable vitality capability within the subsequent 5 years because it has prior to now twenty years. With this market evolution comes the chance for important merger and acquisition (M&A) exercise, and the profile of this exercise is anticipated to shift.

All through 2020 and 2021, M&A exercise for renewables elevated as valuations of platforms, which embrace venture portfolios and company growth groups that handle them, reached all-time highs. Now with the rise in capital deployment charges, there’s a shift from the bulk platform of M&A exercise to transactions the place buyers can purchase a minority stake.

“Buyers present progress capital within the type of a minority stake, usually receiving most popular fairness in an organization that has the potential to develop and increase within the post-IRA world, the place the worth of the corporate could be” g will improve considerably within the subsequent few years,” CohnReznick stated in a whitepaper.

There’s a rising development of worldwide gamers buying skilled US builders with robust venture portfolios, and CohnReznick stated he expects this development to proceed in 2023. Worldwide impartial electrical energy producers and infrastructure funds see the acquisition as an environment friendly software to enter or increase their presence within the rising North American market. Company M&A exercise that features developer expertise and a portfolio of tasks provides the size and effectivity of the transaction that the acquisition of particular person tasks can’t match.

Now that the Funding Tax Credit score (ITC) and Manufacturing Tax Credit score have been prolonged for tasks that start development earlier than 2034, impartial energy producers and infrastructure funds want to entry a a lot bigger venture pipeline by acquisition, in accordance with CohnReznick.

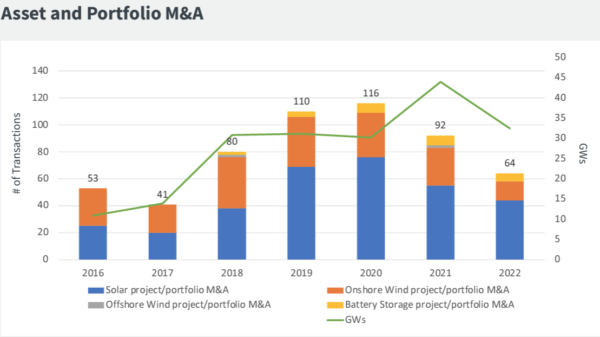

As ITC now consists of vitality storage, this class is anticipated to drive extra M&A exercise as properly. Mercom Capital reported that there have been 23 vitality storage M&A transactions within the first three quarters of 2022 in comparison with 15 in 2021, a development that’s anticipated to proceed because the vitality storage market matures.

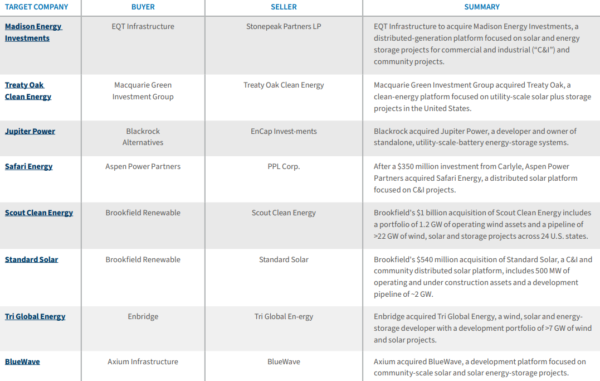

FTI Consulting stated in a whitepaper that notable 2022 M&A transactions embrace Brookfield Renewable’s pair of acquisitions of Scout Clear Vitality ($1 billion) and Customary Photo voltaic ($540 million), Enbridge’s acquisition of Texas wind developer Tri International Vitality for $270 million, and German vitality producer RWE AG’s acquisition of Con Edison’s Clear Vitality Companies for $6.8 billion.

FTC Consulting says that renewable buyers are usually not solely transferring up the worth chain in quest of monetary returns however are additionally diversifying into rising subsectors, comparable to renewable pure gasoline (RNG), different fuels and standalone storage. . Notably, RNG transaction quantity will greater than double in 2022, led by transactions comparable to BP buying Archaea Vitality for $4.1 billion.

FTC Consulting says 2023 deal move is anticipated to stay robust, however artistic options and investor flexibility are wanted because the market navigates continued provide chain challenges, excessive interconnection queue, and excessive inflation price, all of which apply to decrease asset gross sales stress. .

To fulfill these challenges, buyers are anticipated to search for the fitting value offers and transfer in direction of rising applied sciences and subsectors to obtain an simply adjusted price of return on threat. FTC Consulting stated that firms could look to the divestiture of non-core property as a solution to liberate money move for extra strategic investments or different operational drivers.

The report says it might take 4 to 6 months to challenge steering on particular points of the Inflation Discount Act, and builders and asset house owners will want time to evaluate relative worth. of their investments and the implementation of financing crops to benefit from the IRA incentives.

“With endurance, we count on robust M&A exercise in conventional renewable property, platforms and rising applied sciences within the second half of 2023 and into 2024 because the extra readability and elevated worth creation are established,” says the whitepaper.

This content material is protected by copyright and will not be reused. If you wish to cooperate with us and wish to reuse a few of our content material, please contact: [email protected].