[ad_1]

From pv journal USA

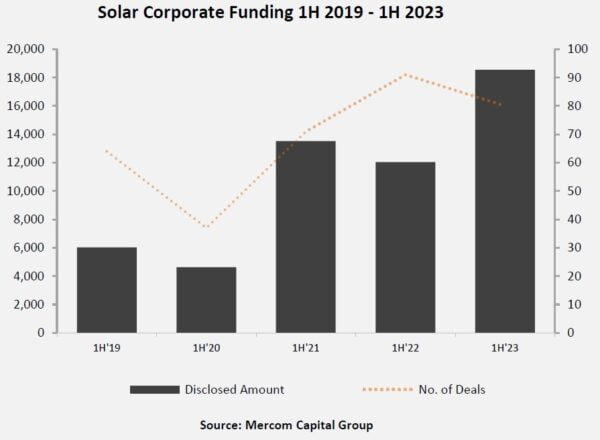

Mercom Capital Group’s “Photo voltaic Funding and M&A, 2023 First Half Report” discovered wholesome monetary exercise within the photo voltaic sector within the first half of 2023. And whereas the variety of offers decreased, whole funding elevated .

Complete company funding – together with enterprise capital funding, public markets, and debt financing – elevated 54% 12 months over 12 months, from $12 billion raised within the first half of 2022. The variety of offers decreased from 91 in the identical interval final 12 months to 80 within the first half of this 12 months, decreased by 12%.

“Even amid the tightening of monetary market circumstances and excessive rates of interest, the photo voltaic trade remained robust within the first half of the 12 months. Aside from AI, cleantech is without doubt one of the few sectors that also attracts curiosity in enterprise capital,” stated Raj Prabhu, CEO of Mercom Capital Group. “Demand as a result of Inflation Discount Act (IRA) is so robust that even the curiosity rate-sensitive public market and photo voltaic debt financing have elevated yearly . The dearth of straightforward cash, nevertheless, has affected M&A exercise negatively.

World enterprise capital funding elevated 3% yearly, with 33 offers price $3.8 billion, in comparison with 53 offers in the identical interval in 2022, price $3.7 billion.

Prime 5 enterprise capital offers:

- 1KOMMAS, $471 million

- Silicon Ranch, $375 million

- CleanMax Photo voltaic, $360 million

- Amarenco, $325 million

- Amp Power India, $250 million

To proceed studying, please go to our pv journal USA web site.

This content material is protected by copyright and is probably not reused. If you wish to cooperate with us and need to reuse a few of our content material, please contact: [email protected].

[ad_2]

Source link